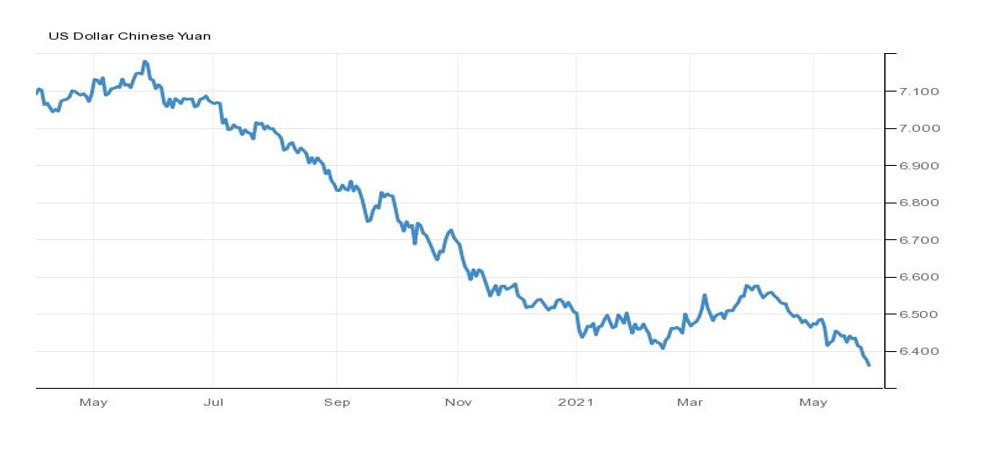

REGULATORY INTERVENTION LIKELY AS YUAN TRADING 3-YEAR HIGH AGAINST US DOLLAR

Chinese Yuan has gained 1.7% so far in May and it breached the psychologically important 6.4 per dollar level last week, On Friday, Yuan traded flat at 3-year highs of 6.37127 against the US Dollar after the People’s Bank of China (PBOC) set the midpoint rate at 6.3858. Friday's official guidance rate was the strongest since May 2018, signalling that the Chinese central bank was comfortable with recent gains. The Yuan is also on track for its best weekly performance since November, lifting 1%, but the pace of the rally has slowed after regulators signalled some concerns over strong one-way bets on the currency.

While China’s economy has rebounded quickly from a pandemic-induced slump early last year, the Yuan’s gains have been largely chalked up to sustained weakness in the dollar. Investors had increased their bets on further strength in the Chinese unit after the PBOC appeared not to show discomfort with recent gains. But big state-owned banks were seen buying U.S. dollars early last week in a move seen as an effort to temper fast Yuan gains.

In recent data, industrial profits in China rose by 106.1% yoy in January-April, after jumping 137% in the prior period, Prices of key commodities including steel products and copper had surged more than 30% since the start of the year, denting corporate profits throughout the supply chain. Surging raw materials costs have also raised worries about inflationary pressures and their potential impact on monetary policy.

China's exports have not been affected too much by the appreciation, which might be because of the coronavirus-triggered production halt globally, as overseas buyers have no choice but to order from China. But when the coronavirus is controlled with help of vaccines, the negative impact of Yuan’s appreciation should show up more evidently and when the Yuan reached 6.0 against the dollar, the government might take measures to control the appreciation trend. Because of China's robust exports trend, the government has high tolerance of the Yuan’s surge, but there will be a limit. Chinese regulators already cracking down on manipulation of the forex market and said the Yuan exchange rate cannot be used as a tool to stimulate exports nor to offset the impact of surging commodity prices.