EUROPE MARKET REMAIN BUOYANT

European shares rose to a record high. Most of the financial stocks are trading positively with reasonable gain fuelled by hawkish comment from a Bank of England official, with the prospects of increased U.S. fiscal spending boosting market sentiment.

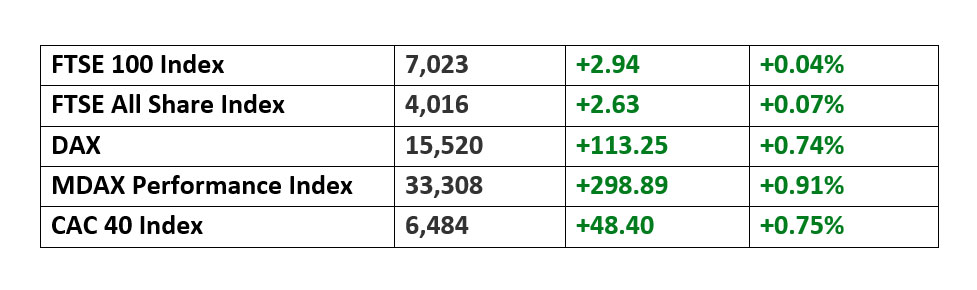

European Market

The pan-European STOXX 600 index rose 0.6% to a record high of 448.98 points and added 1% this week. The Europe-only STOXX index and the European blue chip index added about 0.7% each, trading just below multi-year highs.

DAX finishing above 15,500 for the first time, on growing expectations that the Eurozone economy will begin rebounding at a faster pace in coming months as vaccination drives gather pace. Recent data showing that the Eurozone economic sentiment improved to a three-year high in May offered more evidence that the bloc could be recovering from a double-dip recession. A slew of data releases in the US calendar, including a surge in the PCE price index and better-than-expected weekly jobless claims numbers, reinforced a positive narrative of economic strength but, simultaneously, sparked renewed concerns about runaway inflation. However, investors seemed less worried about tapering as both the Fed and the European central bank have argued that any increase in prices will be transitory.

Gains in British-exposed stocks supported the insurance and financial services sectors, which were the best performing sectors for the day. Bank stocks rose 0.4% to a 15-month high, tracking a rise in euro zone bond yields. British lenders, including HSBC, led the gains after a Bank of England policymaker suggested an earlier-than-signalled hike in lending rates.

The reopening measures have boosted the travel and leisure stocks, which outpaced their regional peers this week with a 4% jump. Data showed economic sentiment improved by more than expected to a three-year high in May, with the strongest gains in services, retail and among consumers as governments eased pandemic restrictions. Among individual movers, Spanish bank Sabadell fell more than 6.5% even after it outlined plans for more cost cuts to improve profitability. French plane maker Airbus extended solid gains from Thursday, hitting a near 15-month high after it outlined plans to nearly double output.

Markets also took comfort in the prospect of more liquidity, after a report said U.S. President Joe Biden will seek $6 trillion in federal spending for 2022. Biden is expected to unveil his first full budget later in the day. Data showed U.S. inflation jumped in April, but Wall Street shrugged off the rise in prices. After reacting dramatically to signs of higher prices earlier in the year the boil has firmly come off the inflation story.