BOND MARKET REMAINS RANGEBOUND

Long-dated U.S. government bond yields on Monday slipped for a third straight session and hit the lowest levels in about two weeks, kicking off the final week of trade this month. However, yield seems to range bound, and likely to be continued to move in narrow range for a while, after a solid ride on last month.

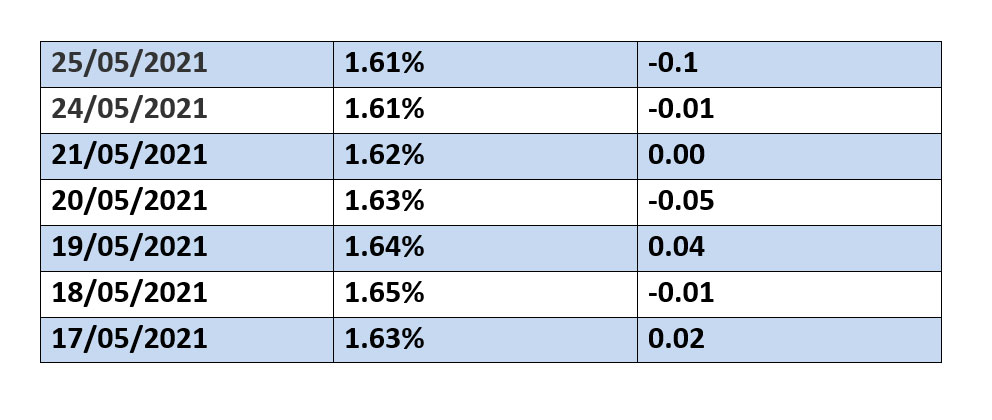

10 year U.S. treasury yield:

For while the U.S. has seen strong growth and surging inflation, which has lifted yields, the Fed still seems pretty steadfast in its view that conditions have not improved sufficiently to entertain the idea of bond tapering or other measures to tighten financial conditions. Though the Federal Reserve aims to avoid volatility in equity markets, investors are likely to continue overreacting in anticipation of and immediately following FED comments. Similarly, inflation and employment data in the coming weeks could weigh heavily on sentiment, given their implications for Fed action (or inaction)

In the Eurozone, it looks as if economic optimism is improving, after some softening earlier in the year. However, yields have started to rise again and the ECB is left with a tricky decision. Does it argue that financial conditions are still being unnecessarily tightened by the rise in yields, and maintain the faster pace of PEPP purchases? Or does it conclude that the economy is now sufficiently robust to accept the rise in yields and trim PEPP purchases back to their pre-Q2 pace.

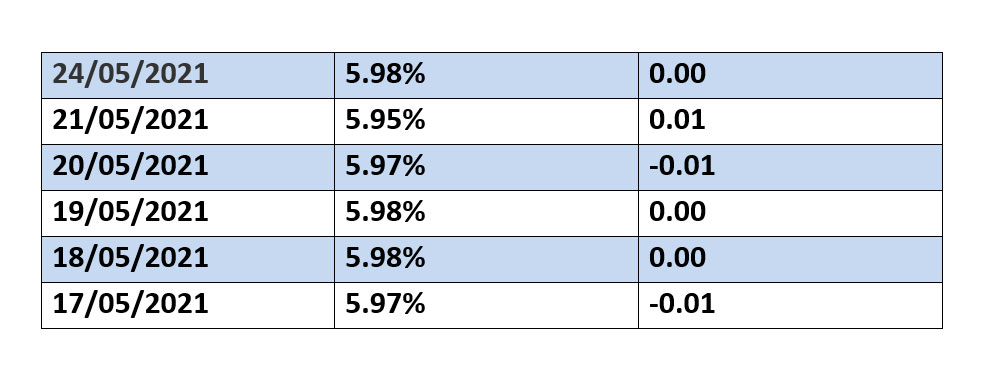

Indian 10 year Govt bond yield.

Indian bond yield has been hovering around 6% . In April, the RBI launched G-SAP under which it said it would buy Rs 1 lakh crore worth of bonds in the April-June quarter. It has so far bought Rs 25,000 crore worth of government securities (G-secs). The 10-year bond has declined 15 basis points from 6.15% in the last one month.

RBI continued to send strong yield signals by cancelling and devolving government debt auctions. In the last month alone, the RBI cancelled more than Rs 30,000 worth of debt auctions. Although part of this amount was offset by availing the green-shoe option (option to accept bids for more than the notified amount of debt auction) in other securities, the decision to buy Rs 35,000 crore worth of bonds in May would help the market absorb a portion of the Rs 1.16 lakh crore market borrowings by the government during the month.