WEEKLY EQUITY REPORT: INDIAN EQUITY MARKET WITNESSED A WEEKLY LOSS OF 1.60%

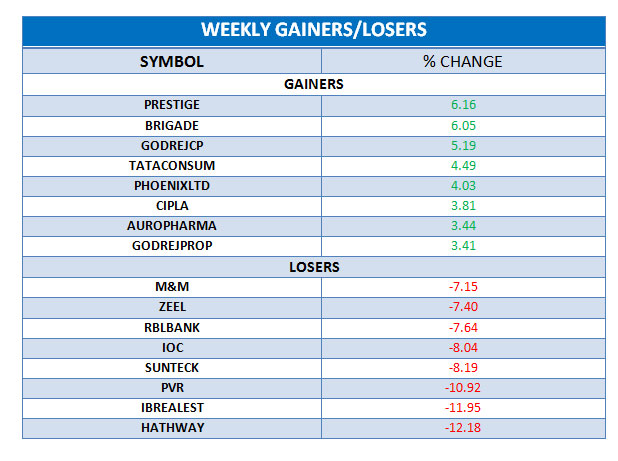

Domestic Equity Market continued the negative momentum and reported a loss. During this week, the Nifty Fifty reported a loss of 1.60% over the previous week’s close. Sectoral Indexes like Pharma, Metal Indexes were the gainers with having gains of 1.85%, 0.59% respectively whereas Media, Auto, Energy, Bank, IT, FMCG, Realty were the losers with having loss of 6.62%, 4.07%,4.04%, 2.47%, 0.69%, 0.62%, 0.14% respectively. Domestic Equity Market ended the Monday’s volatility session on a flat note tracking fear of a second coronavirus wave, elevated bond yields and weak global cues weighed on the market. Domestic Equity Market has shown a positive sign on Tuesday led by gains in banks and financial services stocks. Domestic Equity Market has shown a negative sign on Wednesday dragged by heavy selling across the board amid weak global cues. Domestic equity market closed with lower note on Thursday tracking Weak global cues coupled with March series F&O expiry. Domestic Equity Market has shown a positive sign on Friday led by gains in Metals, Auto, Telecom and FMCG Sector.

TOP STOCKS IN NEWSCAST:

Prestige real-estate gained over 6% as Prestige Estates Projects will take over a Mumbai housing project from bankrupt Ariisto Developers following a court decision.

Brigade surged 6.05% as Brigade Group today handed over bicycles to deserving school children in and around the villages of Hoskote, a taluk in Bangalore Rural District of Karnataka under its corporate social responsibility (CSR).

Tata Consumer rose over 4% as Tata Consumer Products Limited (TCPL) has created an autonomous and integrated supply chain with Blue Yonder, world leader in digital supply chain and Omni-channel commerce fulfilment, and implemented by Accenture.

Cipla swelled over 3% as Cipla Ltd’s US specialty business division has entered into an agreement with US-based SIGA Technologies Inc to develop novel antibiotics.

Hathway lost over 12% as Reliance Industries Ltd (RIL) is getting ready to divest its shares in Den Networks and Hathway Cable through offers for sale (OFS) in compliance with the minimum public holding norms laid down by the Securities and Exchanges Board of India (SEBI).