WEEKLY EQUITY REPORT: INDIAN EQUITY MARKET STAYED IN RED DURING THE WEEK AND REPORTED A LOSS OVER 1%

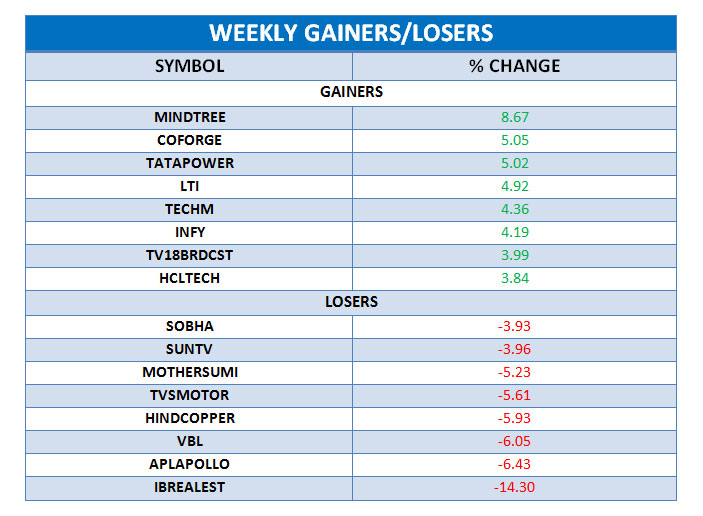

Domestic Equity Market continued in sideways momentum and witnessed a loss. During this week, the Nifty Fifty reported a loss of 1.90% over the previous week’s close. Domestic Equity Market showed a negative sign on Monday on the back of weak macroeconomic data (dip in IIP, rise in inflation) and resurgence in Covid-19 infections. Domestic Equity Market ended lower for the third consecutive session on Tuesday as investors fretted over rising cases of Covid-19 cases in the country and amid new localised restrictions. Domestic Equity Market closed with a lower note on Wednesday as dragged by across the broad selling amid mixed global cues. Domestic Equity Market ended lower on Thursday as US Treasury yields recorded a steep uptick of 5 per cent, causing equity holders to unwind their long positions. Domestic Equity Market closed higher on Friday as bulls fought back to lift indices over a per cent higher. FMCG Index was the only gainer of the week with a gain of 2.90% whereas Realty, Pharma, Bank, Media, Auto, Energy Indexes were the losers of this week with a loss of 5.81%, 4.24%, 3.76%, 3.57%, 1.90%, 1.72% respectively.

TOP STOCKS IN NEWSCASTS:

Coforge surged nearly 9% backed by volumes .In the last five days the average volumes are up as much as 129 percent compared to daily average volumes on monthly basis in the last one month.

ITC swelled over 8% on expectations of increased contribution from its expanding fast moving consumer goods (FMCG) portfolio, a stable tax regime, and attractive valuations.

Mindtree gained over 5% as India Ratings and Research has upgraded Mindtree's Long- Term Issuer Rating to 'IND AAA' from 'IND AA+'.

JSW steel rose over 5% as UBS has upgraded its ratings on JSW steel from ‘neutral’ to ‘buy’ as the domestic businesses reported its highest ever operating profit in the December quarter.

India Bulls plunged over 9% as Promoters of realty developer India bulls Real Estate have sold an additional 4.4% stake in the company through open market.