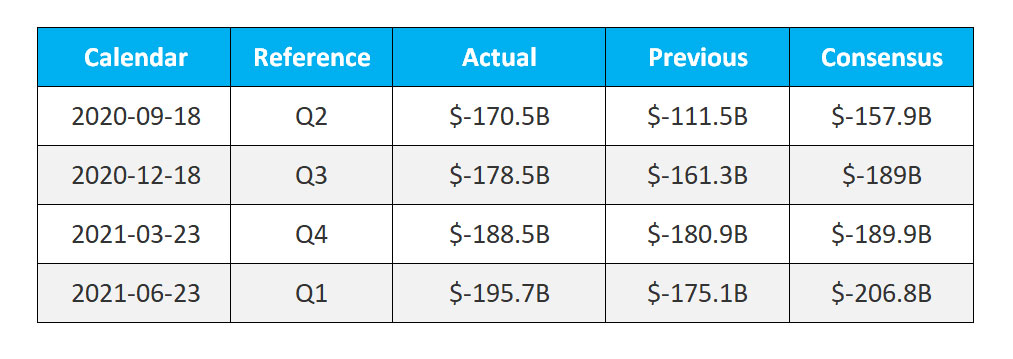

US CURRENT ACCOUNT DEFICIT WIDENED TO MULTIYEARS HIGH

The current account deficit in the US widened to $195.7 billion or 3.6% of the GDP in the first quarter of 2021 from a downwardly revised $175.1 billion in the previous period and compared to forecasts of a $206.8 billion. It is the 14 year high since the first quarter of 2007, due to an increased deficit on goods and a reduced surplus on primary income.

Data for the fourth quarter was revised to show a $175.1 billion gap. The current account gap represented 3.5% of gross domestic product last quarter. That was up from 3.3% in the fourth quarter and the largest since the fourth quarter of 2008.Still, the deficit remains below a peak of 6.3% of GDP in the fourth quarter of 2005 as the United States is now a net exporter of crude oil and fuel.

The wider deficit is likely not an issue for the United States because of the dollar’s status as the world’s reserve currency. The economy grew at a 6.4% annualized rate in the first quarter. Growth this year is expected to top 7%. That would be the fastest growth since 1984 and would follow a 3.5% contraction last year, the worst performance in 74 years.

Imports of goods jumped $39.9 billion to a record $677.0 billion in the first quarter. Vaccinations against COVID-19 and trillions of dollars in pandemic relief are allowing for a greater reopening of the economy, unleashing pent-up demand, which is being partially satiated with imports. Imports of services increased $1.8 billion to $120.2 billion, mostly reflecting a rise in sea freight transport.

Exports of goods rose $24.5 billion to $408.6 billion last quarter. The increases in both exports and imports reflected increases in nearly all major categories, led by industrial supplies and materials, primarily petroleum and products. Exports of services increased $1.1 billion to $175.9 billion, led by personal travel.

Primary income receipts increased $9.6 billion to $261.7 billion, lifted by a rise in direct investment income, mostly earnings. Payments of primary income increased $13.5 billion to$211.4 billion, driven by gains in earnings and portfolio investment income, mostly interest on long-term debt securities.

Secondary income receipts rose $1.6 billion to $42.6 billion. They were boosted by increase in general government transfers, primarily public sector fines and penalties.