ASIA EQUITY STUMBLE, EUROPE STEADY BUT COMMODITIES & USD GAIN

Asian share markets stumbled on Wednesday as a bout of risk aversion boosted bonds and the dollar, while investors braced for minutes from the Federal Reserve’s last meeting which could confirm a hawkish turn in U.S. monetary policy.

Chinese crackdown on tech companies clearly had an impact. Hong Kong stocks shed another 0.9% to near six-month lows, while U.S.-listed ride-hailing company Didi Global Inc shed more than 20% in New York. Alibaba Group Baidu Inc and JD.com all fell.

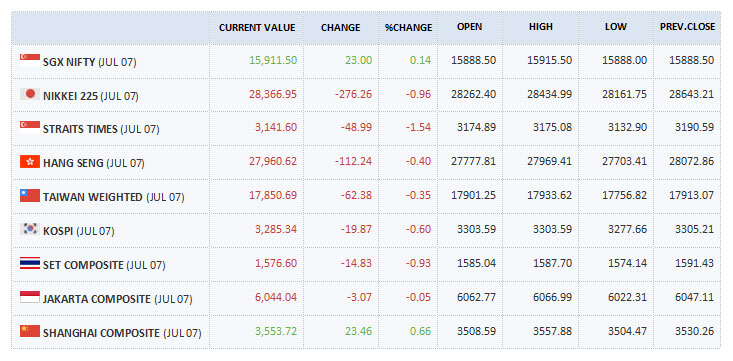

MSCI’s broadest index of Asia-Pacific shares outside Japan edged down 0.6%, while Japan’s Nikkei slipped 1.2%.Bucking the trend, Australian stocks managed to firm 0.7% and Chinese blue chips added 0.8%.

EUROSTOXX 50 futures and FTSE futures added 0.1%, while Nasdaq futures and S&P 500 futures barely moved. Wall Street had been unsettled by a survey showing a slight cooling in the red-hot U.S. services sector, though at 60.1 the ISM index was still historically high.

The skittish mood helped Treasuries extend their recent rally with yields on U.S. 10-year notes dropping almost 8 basis points overnight to 1.348%. That was the lowest since February and also the largest daily decline since February. The outperformance of longer-dated debt saw the yield curve bull flatten, which could be a bet the Fed will tighten policy pre-emptively to head off inflation.Minutes of the Fed’s June policy meeting due later on Wednesday might show how serious members were about tapering their asset buying and how early hikes could begin.

Expectations of a hawkish tone helped the dollar rally against a basket of currencies to 92.543, up from a low of 92.003 on Tuesday. The euro dropped back to $1.1823, near its lowest since March while commodity-linked currencies slipped. The dollar had less luck on the safe-haven yen, holding at 110.57.

In commodity markets, the bounce in the dollar offset the general risk-off mood to leave gold steady at $1,797 an ounce after briefly reaching as high as $1,814 overnight. Oil prices had shed some recent gains after OPEC producers cancelled a meeting when major players were unable to come to an agreement to increase supply. [O/R]. Brent up 3 cents at $74.56 a barrel, while U.S. crude added 12 cents to $73.49.