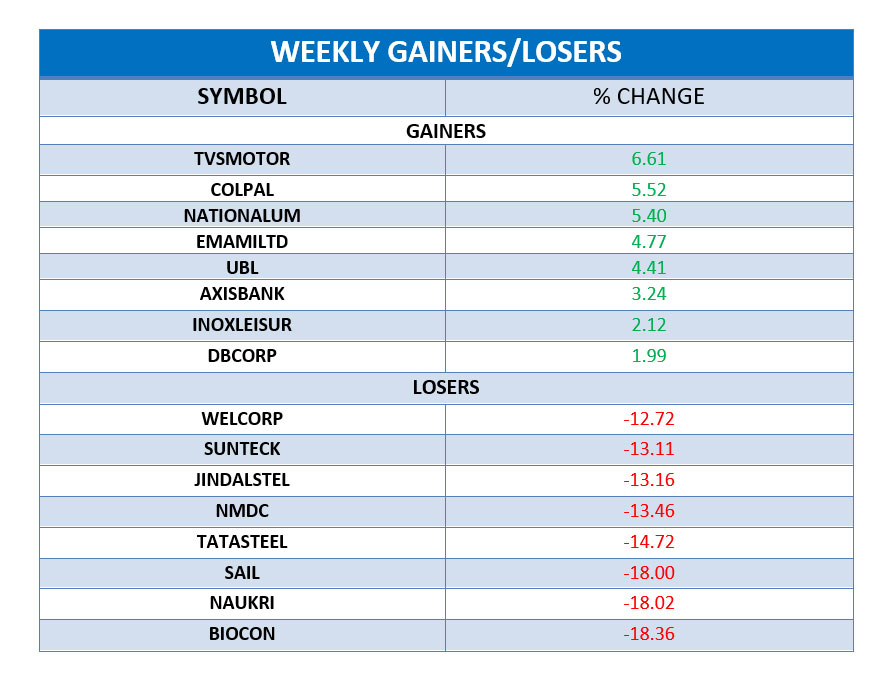

WEEKLY EQUITY REPORT:INDIAN EQUITY MARKET STAYED UNDER PRESSURE THROUGHOUT THE WEEK

Domestic Equity market continued the downward motion and ended the week with heavy loss. The NSE Nifty witnessed a loss of 5.10% over last week’s close. All the sectoral Indices were the losers. Metal, Realty, IT, Auto, Pharma, Energy were the topmost losers with having losses of 10.78%, 7.73%, 6.96%, 6.68%,6.49%, 6.38% respectively. Market ended with losses on Monday dragged by selling in IT, auto and FMCG stocks. Market was closed on Tuesday on the occasion of “Republic Day”. Domestic Equity Market showed a negative sign on Wednesday and fell nearly 2% led by losses in index heavyweight Reliance Industries, private lenders and select IT stocks. Domestic Equity market extended losses for the fifth straight session on Thursday tracking negative global cues amid investors booking profits at higher levels ahead of Union Budget. Market reacted negatively on Friday and lose around 1.50% dragged by heavy selling in IT and auto stocks.

TOP STOCKS IN NEWSCAST:

TVS Motors surged over 6% as the firm posted the highest-ever profit of Rs 266 crore during the quarter ended December 31. The two-wheeler company has clocked the highest-ever revenue of Rs 5,404 crore in the third quarter of FY20-21.

Colgate Palmolive jumped 5% in this week after the company reported a double-digit year on year (YoY) growth of 10.1 per cent in domestic sales for the quarter ended December 2020 (Q3FY21).

National Aluminium rose 5% as the company approved share buyback of 13.03 crore shares at ₹57.50 per share. The company is thus offering shares worth ₹749.23 crore.

Emami Ltd gained over 4% as the company reported 44.67 per cent rise in consolidated net profit at Rs 208.96 crore for December quarter 2020 helped by sales growth and cost control measures. The company had posted a profit after tax of Rs 144.44 crore for the year-ago period.

UBL rose 4% as the company’s profit before tax stood at Rs 170.88 crore in Q3 FY21, up 20.7% from Rs 141.62 crore in Q3 FY20.