WEEKLY EQUITY REPORT:INDIAN EQUITY MARKET WITNESSED A FALL IN THIS WEEK

Domestic Equity Market move sideways this week and ended with a loss. The NSE Nifty witnessed a loss of 0.40% over last week’s close. Barring Auto and IT Indexes, all the Indexes were the laggards. Auto and IT Indexes were having gains of 3.32% and 0.48% respectively whereas Metal, Pharma, Bank, Realty, Media, FMCG, Energy Indexes were having loss of 6.31%, 3.63%, 3.35%, 3.28%, 2.45%, 0.58%, 0.47% respectively. Domestic Equity Market plunged nearly 1% lower on Monday amid weak global cues and selling pressure across sectors. Market jumped nearly 2% of gain in today’s session tracking Solid December quarter results, along with positive global cues fulled an across-the-board buying in the equity markets on Tuesday. Domestic Equity Market hit record highs on Wednesday’s session led by gains in IT and Auto stocks amid positive global cues. Domestic Equity Market trimmed all the morning gains amid reports of a fire in the Serum Institute of India plant in Pune on Thursday. Domestic equity market fell on Friday dragged by weak global markets and selling seen in metal and banking indices.

TOP STOCKS IN NEWSCAST:

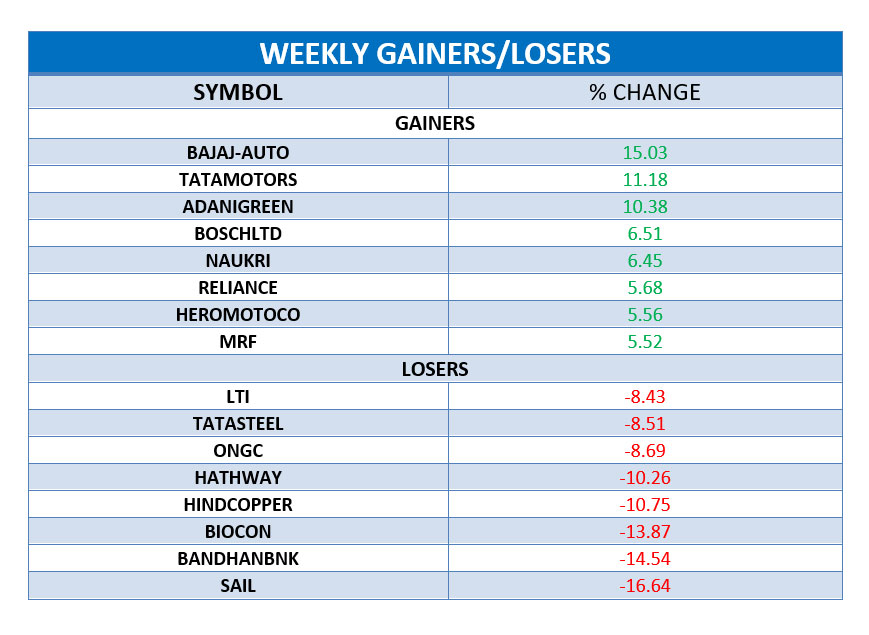

Bajaj Auto surged over 15% as the company reported 23% rise in standalone net profit at ₹1,556 crore for the quarter ending 31 December, 2020.

Tata Motors gained 11% after the company's subsidiary Jaguar Land Rover (JLR) posted a second successive quarter-on-quarter (QoQ) recovery in sales, despite the continuing impact of Covid-19.

Reliance rose over 5% as the company has reported a 40.5 percent sequential growth in consolidated profit at Rs 14,894 crore for the quarter ended December 31, 2020, driven by robust revival in O2C and retail segments, and a steady growth in digital services business, with Jio showing a 15.5 percent QoQ growth in profit and 4.1 percent rise in ARPU.

Sail lost over 16% on media reports that China is considering allowing some stranded Australian coal cargoes amid ban on coal imports from Australia.

Bandhan Bank fell over 14% as the bank reported a 13.4 per cent decline in the net profit to Rs 633 crore compared to Rs 731 crore for the year-ago period.