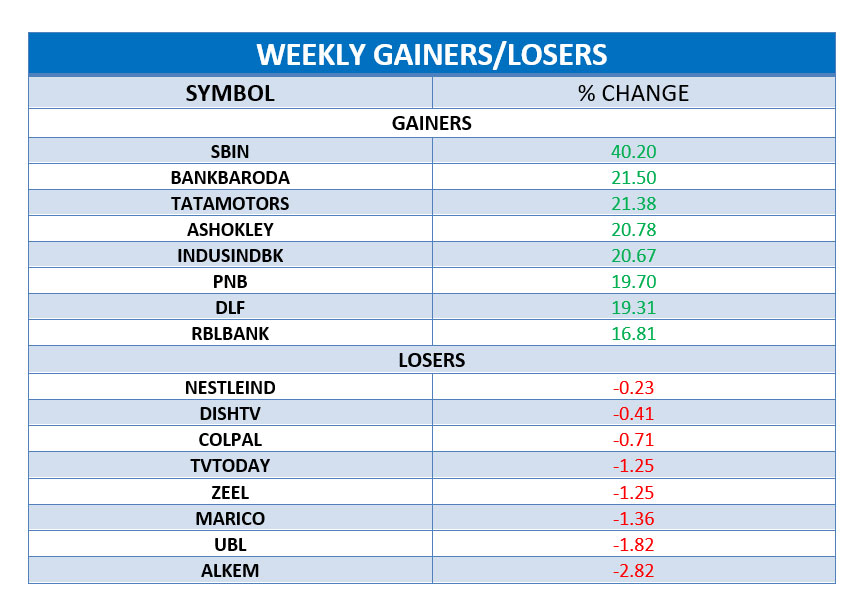

WEEKLY EQUITY REPORT:DOMESTIC EQUITY MARKET TRIMMED ALL PREVIOUS WEEK’S LOSS AND RECORD ALL TIME HIGHS AFTER BUDGET ANNOUNCEMENT

Indian equity Market recovered from all previous week’s loss and ended the week with a strong gain. The NSE Nifty witnessed a gain of 9.50% over last week’s close. All the sectoral Indexes were in the gaining streak. Bank, Metal, Realty, Auto, Energy Indexes were the outperformer with a gain of 16.65%,11.88%, 11.66%, 9.28%, 7.77% respectively. On Monday Indian market posted huge gains as investors cheered the Budget 2021 presented by Finance Minister Nirmala Sitharaman in the Parliament. On Tuesday, the domestic market continued to rise as investors continue to cheer Budget announcements amid positive global cues among. Indian benchmark Indices clocked new record high on Wednesday after a survey showed the country’s dominant services sector picked up in January as demand improved. Domestic Equity Market ended with a decent gains on Thursday led by FMCG, metal, and banking stocks. Indian Market ended with gains on Friday tracking a status-quo in policy rates by the Reserve Bank of India (RBI) kept markets afloat .

TOP STOCKS IN NEWSCAST:

State Bank of India(SBI) jumped over 40% this week as the bank reported a beat on its December quarter results (Q3FY21) on the back of healthy asset quality, fewer fresh slippages, and lower-than-projected rise in provisions.

Bank of Baroda surged over 21% as the bank reported a good set of numbers on the operating as well as business front compared to the previous quarter.

Tata Motors gained 21% after the company retained positive momentum and reported a 15 per cent month-on-month (MoM) and 94 per cent year-on-year (YoY) growth in domestic passenger vehicles (PV) sales at 26,978 units during the month January 2021.

Ashok Leyland rose over 20% as the company reported a 32 per cent increase in M&HCV truck sales in January 2021 to 6,399 units from 4,837 units in January 2020. However, bus sales dropped by 79 per cent to 440 units from 2,112 units, a year ago.

IndusInd Bank gained over 20% as the bank reported a consolidated Net Profit for the quarter ended December 31, 2020 at Rs830cr as compared to Rs1,309cr during corresponding quarter of previous year, de-gowth of 37% yoy.