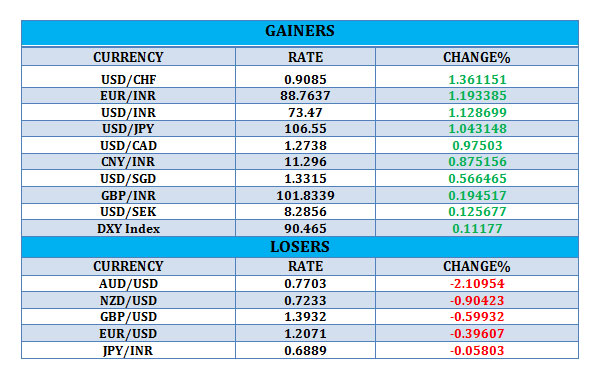

WEEKLY CURRENCY REPORT:RUPEE ENDS THE WEEK 1.12% LOWER AGAINST US DOLLAR

On a weekly basis, the rupee has tumbled 82 paise against the US dollar as a rout in global bond markets weighed on investor sentiments. Higher crude prices also kept the pressure on the rupee. USD/INR touched low at 72.26 and high at 73.49. At the beginning of the week, Rupee gained 16 paise to settle at 72.49 against the US dollar on Monday supported by sustained foreign fund inflows and expectation of improved macro-economic data. The rupee slipped from the day's high level and marginally gained 5 paise against the US dollar on Tuesday, to settle at 72.44 tracking muted domestic equities and stronger American currency against key rivals. The rupee gained 12 paise to settle at 72.33 against the US dollar on Wednesday supported by positive domestic equities and weakness of the American currency in the overseas market. The Indian rupee ended 9 paise lower at 72.43 against the US dollar on Thursday, weighed down by the spike in global crude oil prices. The USDINR also remained very volatile ahead of the expiry. Indian rupee and stocks plunged on Friday along with markets across Asia amid global selloff in risk assets sparked by the surging US yields. The rupee tanked by 103 paise to 73.47 against the US dollar, its biggest drop since March. The yields on domestic benchmark 10-year bonds also spiked. After rallying at the start of 2021, developing-nation assets have slumped during the past two days as US Treasury yields jumped to the highest level in more than a year, sounding a warning about the outlook for interest rates and inflation.