WEEKLY EQUITY REVIEW: INDIAN EQUITY MARKET WITNESSED A LOSS OF 2.69% THIS WEEK AMID WEAK GLOBAL CUES.

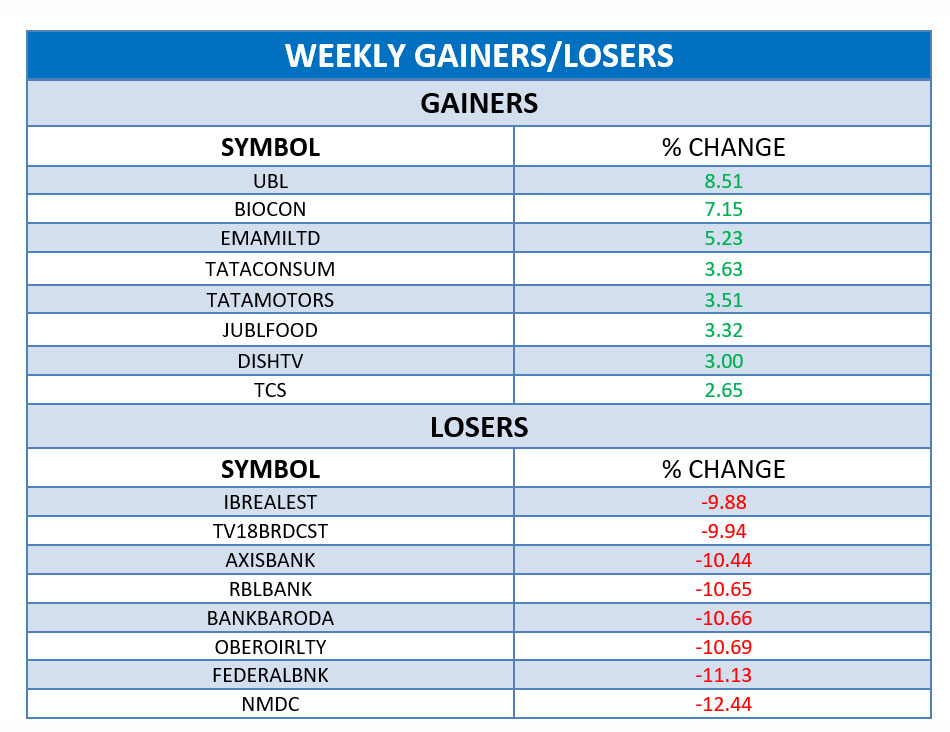

Last week, Nifty fifty witnessed a gain of 2.43%. During this Week, Domestic equity market witnessed a downward motion and ended the week with a loss of 2.69% over last week’s close. Domestic Equity Market ended with losses on Monday amid fresh flare-up on the border tensions between the India and China. Domestic Equity market inched higher on Tuesday led by gains in metals, pharma and FMCG stocks amid positive global cues. Domestic Equity Market ended higher on Wednesday led by buying in Reliance Industries (RIL), Mahindra & Mahindra (M&M), Infosys, and TCS. Domestic Equity Market ended with negative notes on Thursday dragged by financial stocks and index heavyweights RIL and Bharti Airtel. Domestic Equity Market ended lower on Friday dragged by selling across the board amid weak global cues. All the sectorial Indexes were the losers of this week. IT, FMCG, Media, Auto, Metal, Pharma, Energy, Realty Indexes were having a loss of 0.27%, 1.36%, 1.48%, 1.505, 2.74%, 2.94%,3.41%, 5.60% respectively.

TOP STOCKS IN NEWS:

UBL (United Breweries Ltd) gained 8.51% in this week as the company is expecting further acquisitions and entry of new players in the Indian beer market, despite disruptions due to Covid-19 and higher taxes by some states.

Shares of Biocon Surged 7.15% on weekly basis as Biocon Biologics India receives Rs 225 crore equity infusion from Tata Capital Growth Fund II.

NMDC lose 12.44% as the company recorded iron ore production of 1.62 mn t in Aug'20 which fell 26% on a monthly basis compared to 2.19 mn t in July'20.

Bank of Baroda fell over 10% as Bank of Baroda (BoB) has hiked the risk premium it charges from August onwards for new customers.