WEEKLY EQUITY REVIEW: INDIAN EQUITY MARKET ENDED FLAT THIS WEEK

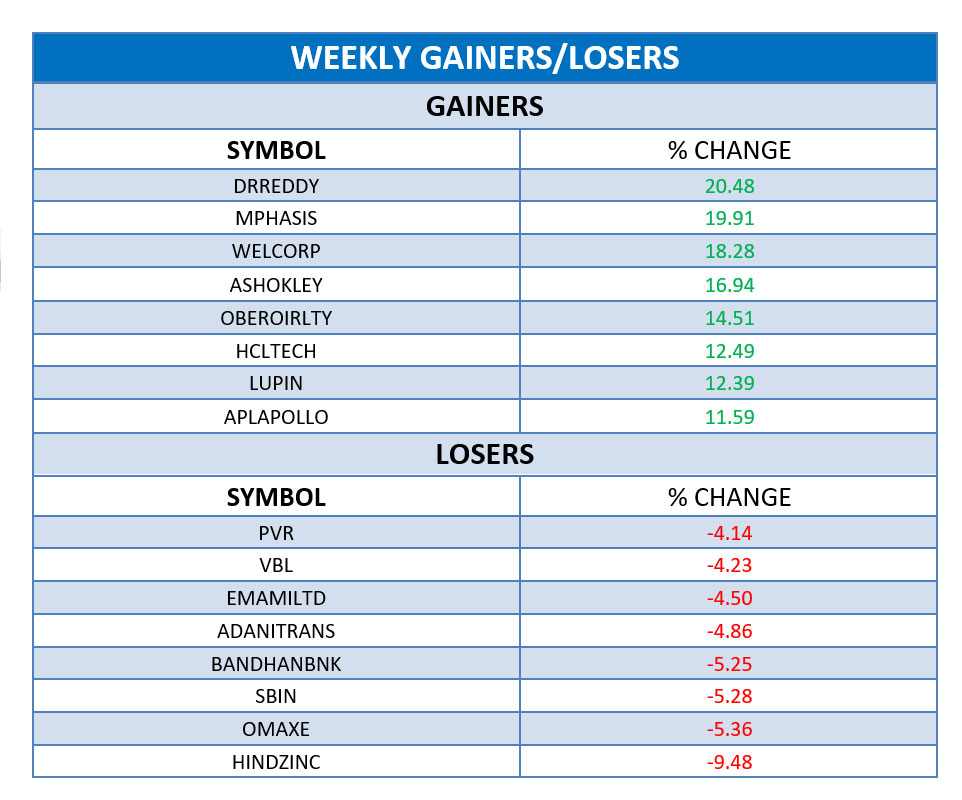

Last week, fifty witnessed a loss of 1.15%. During this Week, Domestic equity market stayed volatile and ended the week with a slight gain of 0.35% over last week’s close. Domestic Equity Market ended lower on Monday due to selling in blue-chip counters such as HDFC Bank, HDFC, Reliance Industries (RIL), ICICI Bank, and Bharti Airtel. Domestic equity market ended higher on Tuesday led by the positive sentiment across global markets and buying sentiment in pharma and financial space. Domestic Equity Market ended higher on Wednesday thanks to buying in blue-chip counters such as HDFC Bank, Infosys, Mahindra & Mahindra (M&M), and ICICI Bank along with buying witnessed in auto, realty and pharma stocks. Domestic Equity Market ended lower on Thursday amid weak global cues along with losses in metal and bank indexes. Domestic Equity Market ended lower on Friday due to selling in the financial counters. However, gains in pharma and auto stocks capped the losses. Sectoral Indexes like Pharma, IT, Realty, Auto, Media Indexes were the gainers with a gain of 8.91%, 6.41%, 5.49%, 2.58%, 0.10% respectively whereas Bank,FMCG,Energy,Metal Indexes were the losers with a loss of 2.00%, 1.65%, 1.04%, 0.93% respectively.

TOP STOCKS IN NEWS:

Shares of Dr Reddy's Laboratories jumped nearly 20 per cent in this week as the company said it has settled a litigation with a unit of Bristol Myers Squibb related to patents for Revlimid (lenalidomide) capsules, used in the treatment of cancer.

Mphais gained over 19% as the company won a coveted Brandon Hall Group Gold award for excellence in the Talent Acquisition category.

Ashok Leyland rose over 15% on weekly basis as the company has received a large order from a logistics start-up company, Procure Box, for supply of 1,400 intermediate commercial vehicles (ICVs) for an undisclosed sum.

Omaxe Limited lose over 5% this week as the company’s Consolidated net revenue in Q1FY21 stood at Rs50.75cr, which declined by 85.63% yoy from Rs353.06cr in Q1FY20.