WEEKLY EQUITY REVIEW: INDIAN EQUITY BENCHMARK INDICES CLOSED HIGHER FOR THIS WEEK

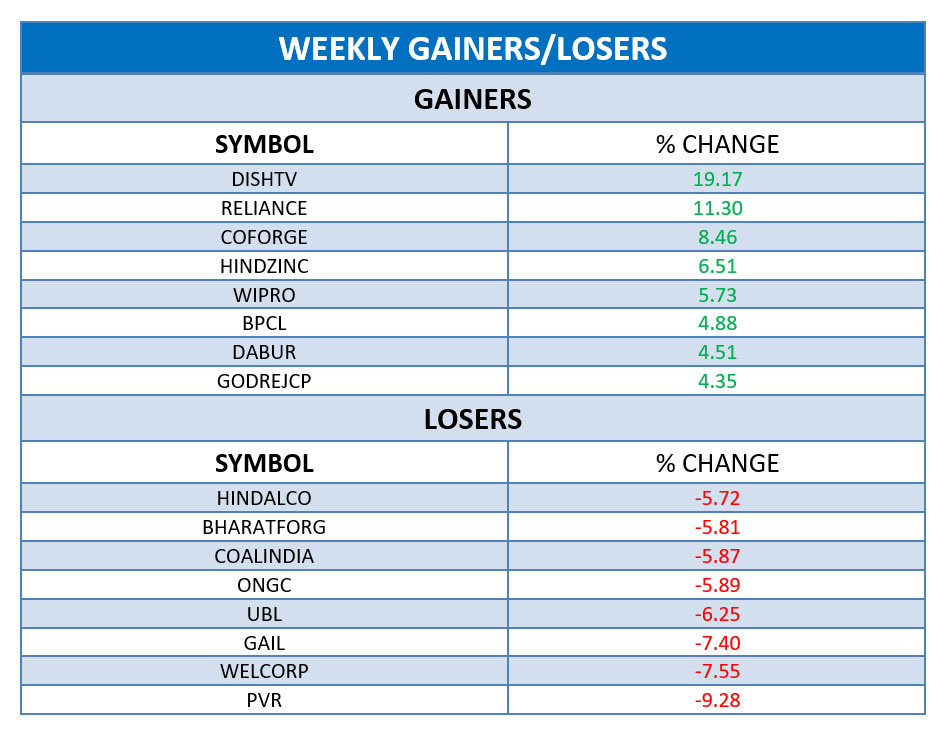

Last week, Nifty fifty witnessed a loss of 2.69%. During this Week, Domestic equity market stayed volatile and ended the week with a gain of 1.15% over last week’s close. Domestic Equity Market ended with small gains on Monday swinging between losses and gains, Indian equities. The recovery was largely fuelled by banking stocks. Domestic Equity Market ended with lower Note on Tuesday dragged by Metal, Bank and Pharma Stocks along with selling in blue-chip counters such as Bharti Airtel, Axis Bank, HDFC, and Hindustan Unilever (HUL). Domestic Equity Market ended lower on Wednesday tracking Weak global cues amid buying in Reliance Industries (RIL), Bharti Airtel, and Tata Steel. Domestic Equity Market ended higher on Thursday boosted by a 7 percent jump in Reliance Industries as it hit a record high after investment in its retail arm. Domestic Equity Market ended with small gains on Friday led by gains in IT, banks and metal stocks. Sectoral Indexes like Energy, IT, FMCG, Pharma Indexes were the gainers with a gain of 3.29%, 3.09%, 0.47%, 0.28% respectively whereas Metal, Realty, Bank, Media, Auto Indexes were the losers with a loss of 2.74%, 2.32%, 2.31%, 0.95%, 0.50% respectively.

TOP STOCKS IN NEWS:

Dish TV gained nearly 20% in this week as the company has to Continue its Investment in Evolving Technologies to fulfil customer needs.

Reliance jumped 11% on weekly basis after Reliance Retail Ventures announced $1 billion investment from Silver Lake Partners.

PVR lose over 9% as the company has deferred its capital expenditure plans in a bid to control costs as the company braces for a significant impact on its profitability in the current fiscal due to the ongoing COVID-19 pandemic.