WEEKLY EQUITY REVIEW: DOMESTIC EQUITY MARKET WITNESSED GAIN OVER 3% THIS WEEK

Last week, Nifty fifty witnessed a loss of 3.95%. During this Week, Domestic equity market stayed volatile and ended the week with a gain of 3.32% over last week’s close. Domestic Equity Market ended with gains on Monday led by gains in bank stocks, while gains in Asian markets further uplifted the sentiment. Domestic Equity market ended flat on Tuesday as banking, financials, Pharma, and FMCG stocks turned negative soon after opening. Domestic Equity Market ended with a slight gain on Wednesday after gains from FMCG, pharma and IT stocks were capped by metal and PSU bank indices. Domestic Equity Market ended higher on Thursday led by gains in banking and media stocks. Domestic Equity Market closed on Friday on account of “Gandhi jayanti”. All the sectoral Indexes were in the gainer side. Media, Bank, Metal, Auto, Realty, IT, Pharma, Energy, FMCG Indexes were having a gain of 7.16%, 6.02%, 4.08%, 3.87%,3.01%, 2.45%, 1.96%, 1.51%, 1.27% respectively.

TOP STOCKS IN NEWS:

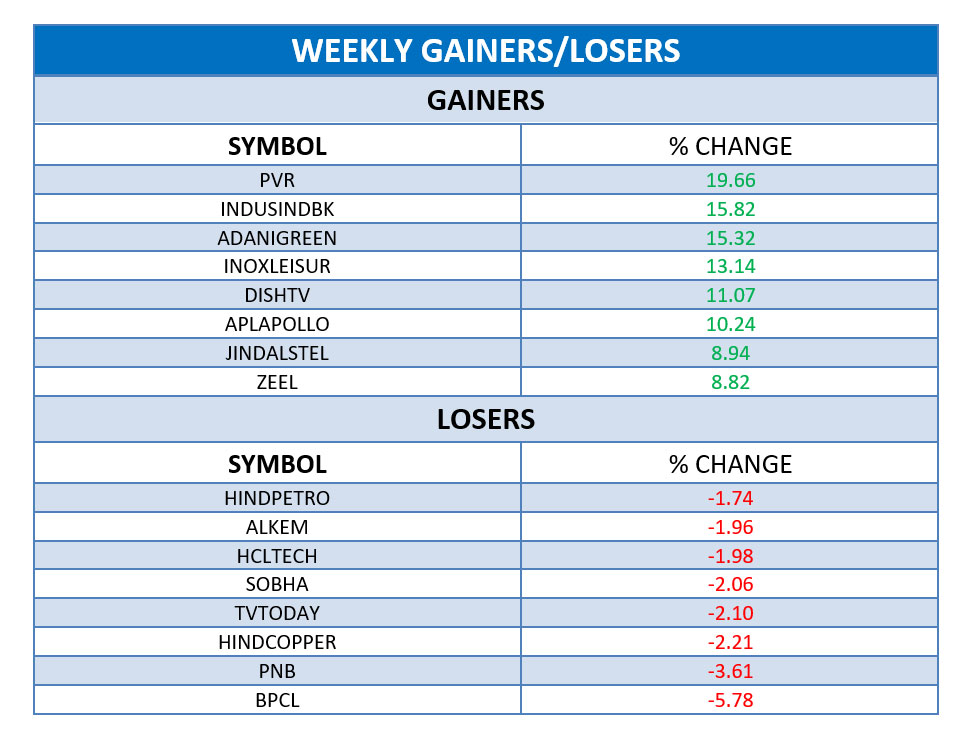

PVR reported a weekly gain of 19.66% as cinema halls and open-air theatres will be allowed to operate with a limited number of participants.

Indusind Bank gained over 15% in this week as brokerages kept faith in the stock.

Adani Green Energy rose over 15% as it had completed the acquisition of 205 megawatt (MW) operating solar assets from the Essel Green Energy and Essel Infra projects for Rs 1,300 crore.

BPCL lose over 5% in this week as The government has for the fourth time extended the deadline for bidding for privatisation of India's second-biggest oil refiner Bharat Petroleum Corp Ltd (BPCL) by one and a half months to November 16.

Shares of PNB Plunged over 3% as the bank has reported a new borrowing fraud worth ₹ 1,203 crore by the troubled Ahmadabad-based Sintex Industries Ltd, whose debt-restructuring plan was rejected by lenders in December last year.