WEEKLY EQUITY REVIEW: INDIAN EQUITY MARKET POSTED A LOSS OF 2.41% IN THIS WEEK

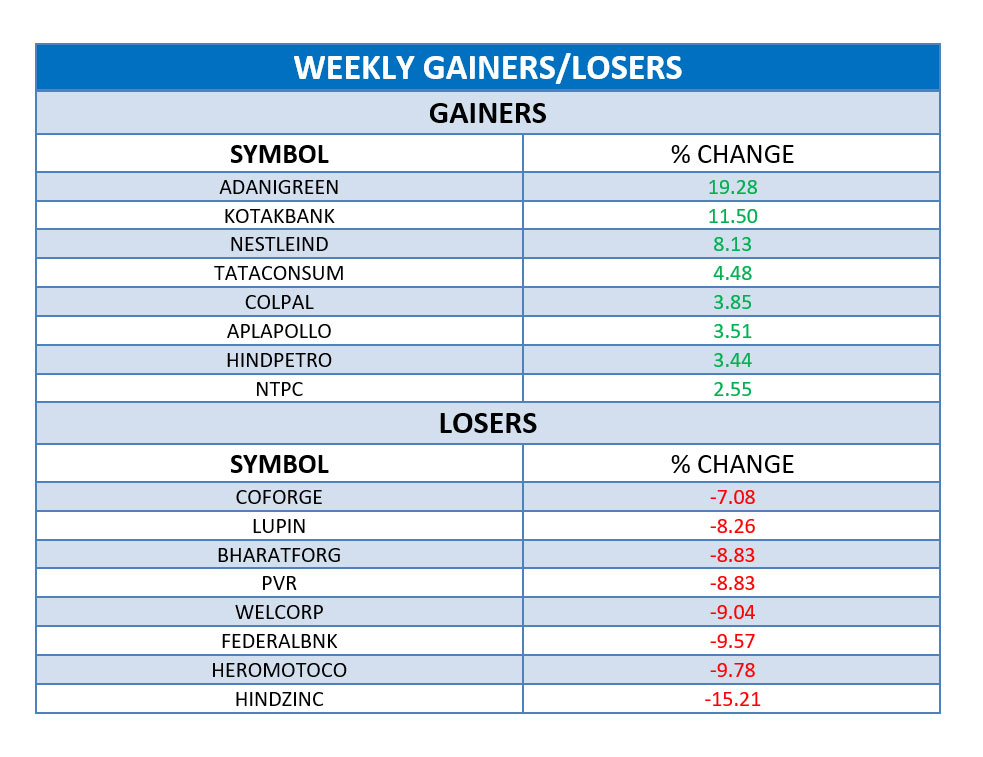

Last week, Nifty fifty witnessed a gain of 1.43%. During this Week, Domestic equity market stayed volatile and ended the week with a loss of 2.41% over last week’s close. Domestic Equity Market ended lower on Monday as selling witnessed across all sectors lead by auto, Metals and bank. Domestic Equity Market traded higher on Tuesday led by gains in Financials and FMCG stocks. Domestic Equity Market traded lower on Wednesday as fears of strict lockdown measures in many European countries spooked investors after coronavirus cases surged at a rapid pace. Domestic Equity market traded lower on Thursday ahead of the expiry of October series derivative contracts. Domestic equity market traded lower on Friday dragged by losses in banks, FMCG and auto sectors. The sentiment was further weighed by a decline in world stocks as jitters over a rising global COVID-19 infection rate and next week’s U.S. presidential election. Energy Index was the only gainer with a gain of 0.51% while Auto, Metal, Media, Realty, IT, Bank, Pharma, FMCG Indexes were the losers with a loss of 4.15%,4.07%,3.20%,2.93%,2.82%,2.36%,2.25%,1.19% respectively.

TOP STOCKS IN NEWS:

Kotak Bank gained over 11% as the bank posted Quarterly Net Profit at Rs. 2,946.62 crore in September 2020 up 22.41% from Rs. 2,407.25 crore in September 2020.

Nestle India gained over 8% after the company reported stronger-than-expected recovery with double-digit sales growth for the quarter ended September 2020 (Q3CY20).

Tata consumer gained over 4% as Tata Consumer Products’ talks with the Coffee Day group for a stake in the latter’s vending business have got stuck over valuation.

Coforge lose over 7% after promoters of the company sold 6.3 per cent equity stake at Rs 2,310 per share on Monday via open market.