WEEKLY EQUITY REVIEW: INDIAN EQUITY MARKET ENDED HIGHER FOR THE WEEK,RECORDED A GAIN OVER 1%

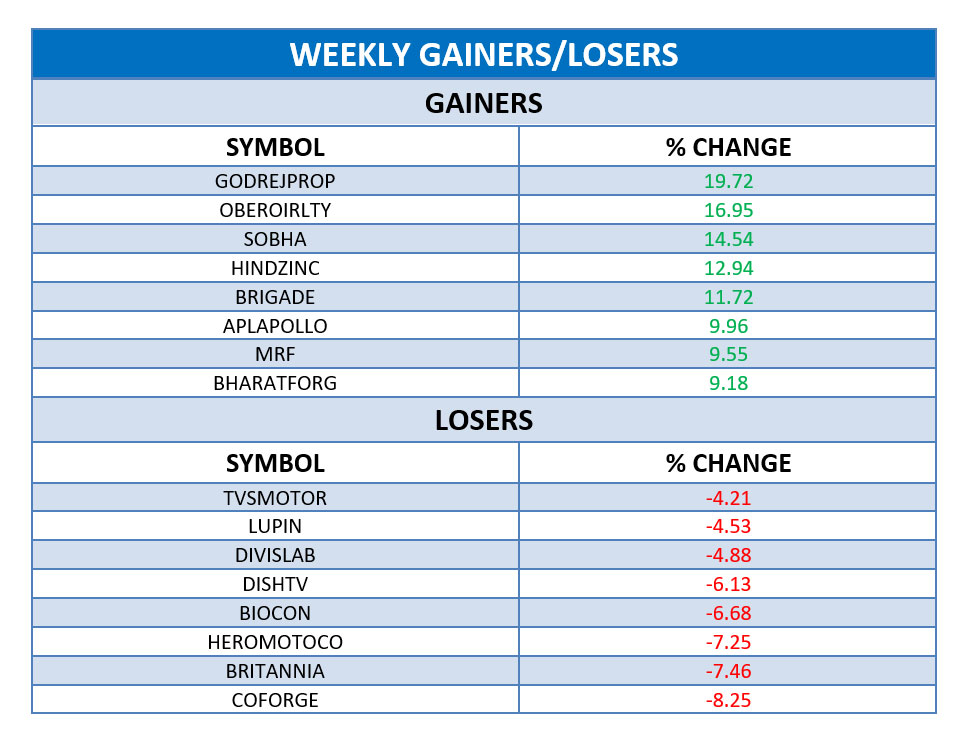

Last week, Nifty fifty witnessed a loss of 1.27%. During this Week, Domestic equity market stayed volatile and ended the week with a gain of 1.43% over last week’s close. Domestic Equity Market ended higher on Monday led by gains in banks, financials and metals stocks. Positive global cues also boosted investor sentiment. Domestic Equity Market ended lower on Tuesday as a slowdown in daily coronavirus cases raised hopes that the government will further ease restrictions. Domestic Equity Market closed higher on Wednesday led by index heavyweights Infosys, HDFC Bank and ICICI Bank. Domestic Equity Market ended lower on Thursday due to the slip in pharma, IT and banking stocks. Domestic Equity Market ended higher on Friday tracking a healthy buying in auto, technology, and select bank stocks. Sectoral Indexes like Realty, Metal, Bank, Energy, Auto, Media, Media ,FMCG Indexes were the gainers with a gain of 9.30%,4.86%,4.02%,2.33%,1.70%,1.18%,0.37% respectively while Pharma, IT Indexes were the losers with a loss of 2.63%,0.07% respectively.

TOP STOCKS IN NEWS:

Oberoi realty gained over 16.95% in this week on expectation of pick-up in residential sales. The company is focused on premium developments in the residential, office space, retail, hospitality, and social infrastructure verticals.

Hindustan Zinc jumped over 12% as the company is working closely with stakeholders for a sustainable future through smart mining, making the processes safer and more efficient across the value chain.

Brigade rose over 11% as the company announced that its wholly owned subsidiary, Mysore Projects has entered into a limited liability partnership agreement with Prestige Estates Projects in Prestige OMR Ventures LLP.

Biocon lose over 6% as the company reported a 23.01 percent fall in its consolidated net profit to Rs 195.4 crore for the second quarter ended September 30, mainly on account of higher expenses.

Britannia plunged over 7.46% after analysts cut the FY21 earnings estimates for the FMCG firm by 4-6 per cent following its second quarter results.