WEEKLY EQUITY REVIEW: INDIAN EQUITY MARKET POSTED A WEEKLY LOSS OVER 1 PERCENT

Last week, Nifty fifty witnessed a gain of 4.36%. During this Week, Domestic equity market stayed volatile and ended the week with a loss of 1.27% over last week’s close. Domestic Equity Market ended higher on Monday led by gains in IT, Pharma and FMCG stocks. Finance Minister Nirmala Sitharaman today announced the government's two-pronged move to boost capital expenditure and stimulate consumer demand. Domestic Equity Market ended flat with positive bias notes on Tuesday tracking gains in IT ,Energy and Metal stocks. Domestic Equity market traded higher on Wednesday supported by buying in financial counters. Domestic Equity Market ended lower on Thursday as a record number of new COVID-19 infections in parts of Europe spooked investors across the globe. Domestic Equity Market ended higher on Friday amid mixed global equities, backed by heavy buying in banking and financial stocks. Metal Index was the only gainer of this week with a loss of 3.05% whereas Media, Auto, Pharma, Energy, IT, Bank, FMCG, Realty Indexes were in the loser side with a loss of 6.82%, 2.50%, 1.91%, 1.83%, 1.37%, 1.31%, 0.84%, 0.16% respectively.

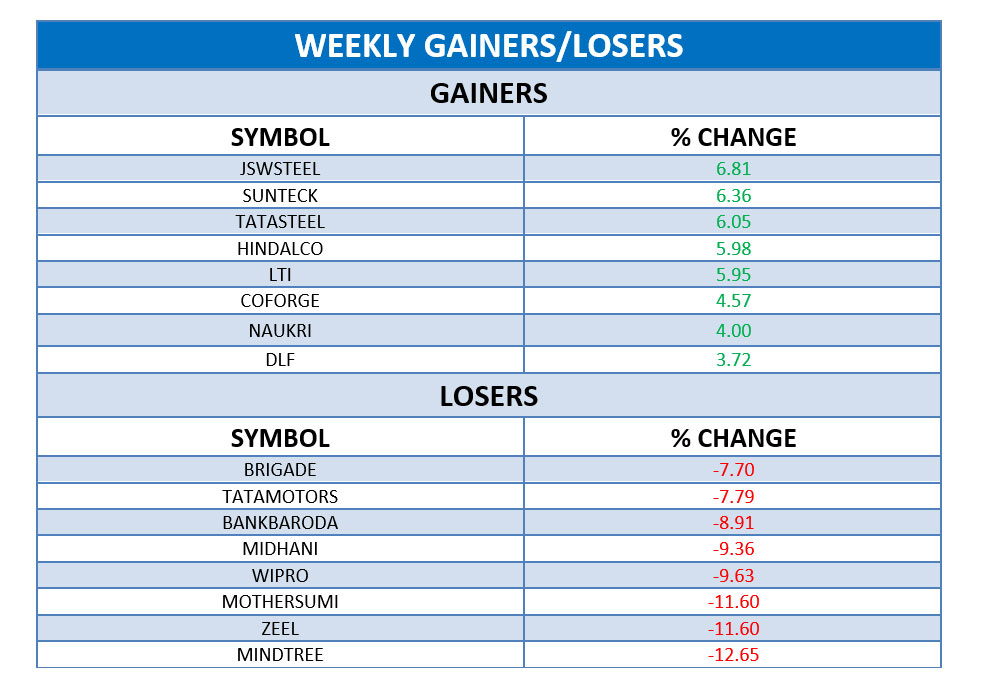

TOP STOCKS OF THE WEEK:

JSW Steel gained nearly 7% in this week as the company raised $500 million through an offshore bond, which could come in handy if the pandemic were to hasten consolidation in the industry.

Tata steel rose over 6% as the steel prices rise above the pre-COVID levels.

Mindtree lose over 12% amid post average Q2 performance, management sees growth momentum to continue in Q3.

Zee limited plunged over 11% after media reports indicated that Siti Networks has defaulted on loan amount of Rs 400 crore against which ZEE has given corporate guarantee of Rs 116 crore.

Wipro fell over 9% as the Q2 results ‘disappointed’ market analysts.