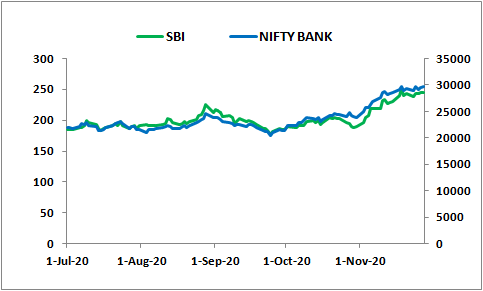

SBI ENDS 29% HIGHER, NIFTY BANK UP 24% IN NOV

As Per above chart SBI follow the trend of Bank Nifty. In the period 2020-21, after declaration of Q2 result the price trend has shown a good rally. SBI up by 0.32% while the sectoral index moved down by 2.39% in Q2 period. But, The Nifty Bank index climbed up as much as 24% where as SBI rallied of 29.06% in the month of Nov. Bank’s second-quarter earnings were much better than it expected on asset quality trends.

Most of banking stocks has also performed in well manner after the announcement of July-Sep quarter. SBI has delivered a strong performance in Q2FY21 with all round improvement in Profitability, Capital Adequacy and Provision Coverage Ratio, including Additional Provision over Minimum Regulatory Provisions required. Bank registered a Net Profit of Rs. 4,574 Crores in Q2FY21, an increase of 51.88% over Q2FY20. Net Interest Income of the Bank grew by 14.56% during Q2FY21. Net NPA ratio stood 1.59%, down 120 bps compared to Q2FY20 and Gross NPA ratio down 191 bps.

Reason behind rally in SBI:

The asset quality has remained under control in stressed times of Covid, which is a big surprise the given past track record of the bank.

The high collection efficiency ratio of the bank indicates that operational reforms on the recovery side have started to show an impact.

Provisions for Covid are good enough for now, though agri and SME loan books have a risk of prolonging the recovery time period.

In the last couple of year, the bank has been getting a few of its subsidiaries listed. Now, their shares are being traded on the stock exchange. The first round of unlocking value has taken place. The requirement of additional funds, if any, could be through selling stake in some of these subsidiaries.