WEEKLY EQUITY REVIEW: INDIAN EQUITY MARKET ENDED THE VOLATILE WEEK WITH A LITTLE GAIN

Domestic Equity Market continued its volatility and ended with a slight gain. The NSE Nifty50 recorded a gain of 0.85% in this week over last week’s close. Domestic equity market traded with positive note on Monday helped by gains in IT and energy stocks. Domestic Equity market stayed in positive territory on Tuesday on signs of progress on a COVID-19 vaccine spurred hopes for a faster economic recovery. Domestic Equity Market has shown negative sign on Wednesday as investors booked profits after a tremendous bull run. Domestic Equity market reacted positively on the last day of the futures and options (F&O) contracts for the November series backed by strong Buying in Metal, IT and Banking Stocks on Thursday. Domestic Equity Market was very volatile on Friday and ended the session in negative territory dragged by losses in bank and IT stocks and heavyweight RIL. Metal Index was the outperformer of this week with a gain of 5.44% followed by Realty, Pharma, Media, Auto, Energy Indexes having gains of 3.94%, 2.71%, 2.60%, 2.38%, 1.83% subsequently.

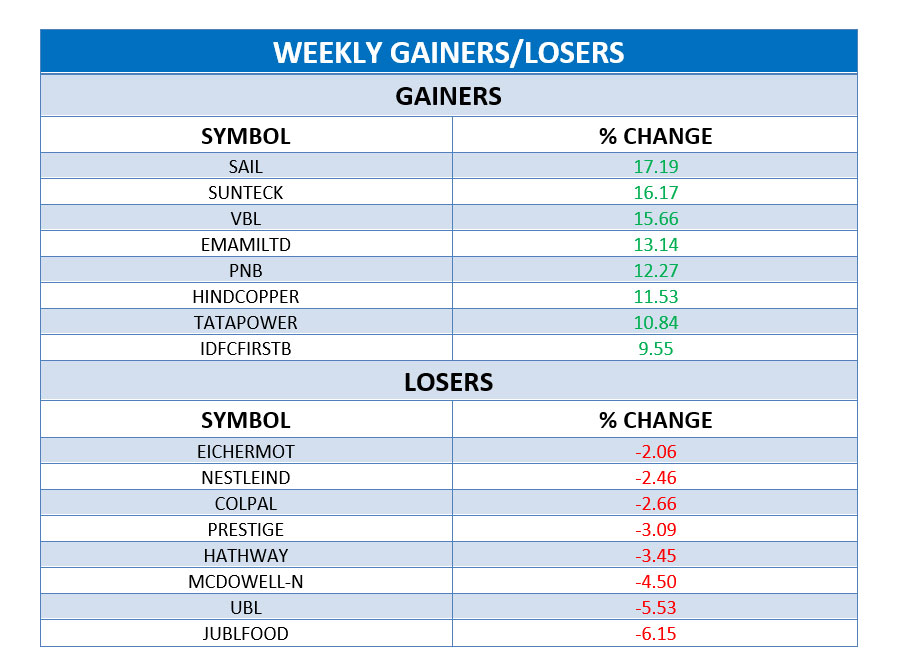

TOP STOCKS OF THIS WEEK:

SAIL(Steel Authority of India) rose 17% with metal Index surged over 5% as Indian primary steelmakers have introduced new schemes to supply steel at preferential prices to micro, small and medium enterprises (MSMEs), amid complaints from MSMEs and the Engineering Export Promotion Council (EEPC) about rising price of the raw material.

Sunteck Realty jumped over 16% on the news of covid-19 vaccine progress.

Emami Ltd surged over 13% as the company is seeking to cash in on Indian consumers slowly leaning towards homegrown brands following the government’s ‘Atmanirbhar’ campaign for its newly launched home hygiene products besides tapping on increased awareness due to Swachh Bharat initiative.

Shares of PNB (Punjab National Bank) gained 12% on weekly basis after ICRA Ratings has upgraded the ratings of Bonds issued by the Bank and reaffirmed the rating of Certificate of Deposits.