INDIAN EQUITY MARKET WITNESSED 2% GAIN ON WEEKLY BASIS;NIFTY REALTY OUTPERFORMED

Domestic Equity Market continued its upward motion and ended the week with gains. The NSE Nifty50 recorded a gain of 2.23% in this week over last week’s close. Market was closed on Monday on the occasion of “Gurunanak Jayanti”. Indian Equity Market showed a positive sign on better than expected cue to GDP and hopes of outcome of vaccine on Tuesday. Indian Benchmark Indices recovered from early losses on Wednesday led by gains in Metal, Auto and IT Sectors. Domestic Equity Markets gave up gains on Thursday after the RBI advised the lender to temporarily halt launches of the Digital 2.0 programme, sourcing new credit card customers. Domestic Equity Market Scaled fresh all time high on Friday after the Reserve Bank of India (RBI) revised upwards the economic growth projections for the fiscal year 2020-21 (FY21).Realty, Metal, Media, Auto, Pharma, Energy Indexes were the outperformer with a gain of 8.50%, 8.05%, 5.35%, 4.62%, 4.35%,4.13% respectively.

TOP STOCKS IN NEWSCAST:

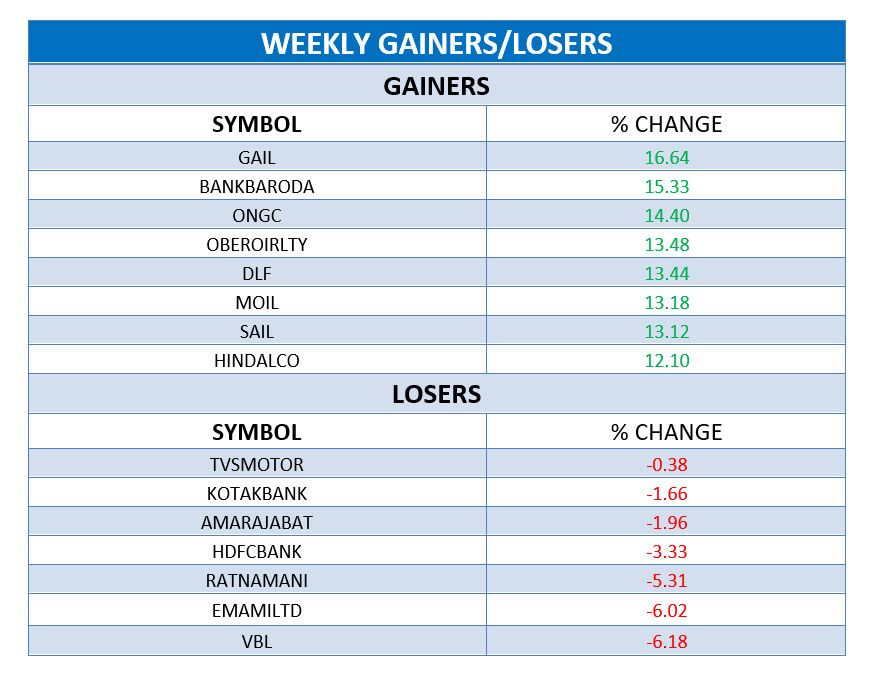

Gail rallied over 16% in this week after oil regulator Petroleum and Natural Gas Regulatory Board (PNGRB) notified regulations for unified gas transmission tariff structure.

Bank of Baroda gained over 15 % as the bank has delivered a strong result on operating, assets quality as well as collection efficiencies front.

Shares of DLF Ltd rose 13% on weekly basis as the company has sold nearly 90 independent floors worth over ₹300 crore in Gurugram and plans to launch more such projects as demand for premium residential properties has revived in last few months.

HDFC Bank plunged over 3% as the Reserve Bank of India (RBI) has asked it temporarily stop all launches of its upcoming digital business-generating activities and sourcing of new credit card customers after outage at its data centre which impacted operations last month.