INDIAN EQUITY MARKET WITNESSED A SLIGHT GAIN OF NEARLY 2% THIS WEEK

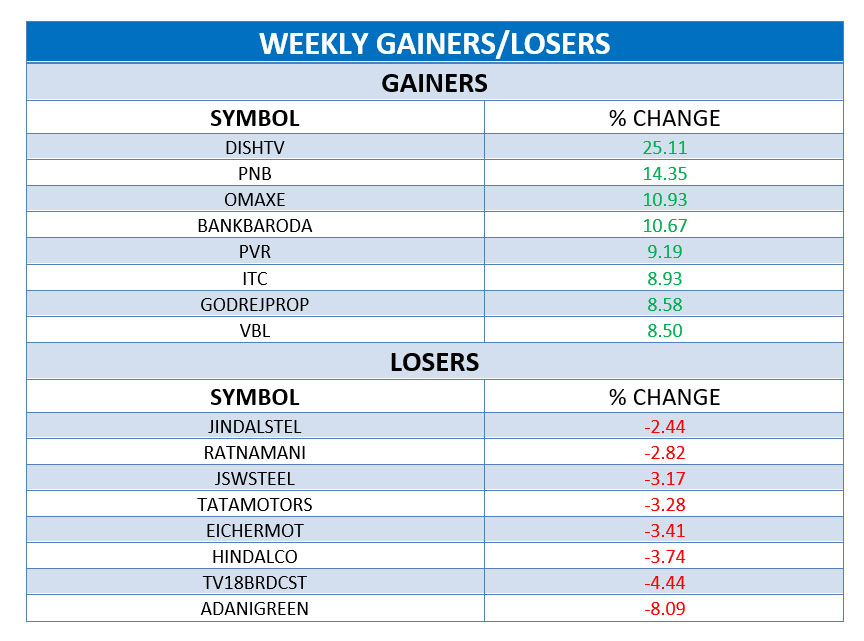

Domestic Equity Market continued its upward motion and ended the week with gains. The NSE Nifty recorded a gain of 1.93% in this week over last week’s close. Domestic Equity Market continued a strong momentum on Monday and ended positively on today’s session led by buying in financial, and FMCG counters. Domestic Equity Market stayed slightly volatile on Tuesday and ended with a positive note amid buying in counters such as Reliance Industries (RIL), TCS, Infosys, and UltraTech Cement. Domestic Equity Market stayed extremely strong on Wednesday led by gains in heavyweights Reliance Industries and HDFC Bank, as hopes for vaccine approvals in the second worst coronavirus-hit nation boosted investor sentiment. Domestic Equity Market showed a negative sign on Thursday dragged by heavy selling in banks, auto, financial services, media and metal stocks amid negative global cues. Indian market closed up on Friday due to liquidity and economic recovery. Sectoral Indexes like FMCG, Media, Realty, Bank Indexes were the gainers with a gain of 6.21%, 4.75%, 3.21%, 1.84% respectively while Auto, Metal Indexes were the losers with a loss of 1.22%, 0.48% respectively.

TOP STOCKS IN NEWSCAST:

Dish TV jumped over 25.11% as the company announced the addition of EPIC ON, a premium OTT platform by IN10 Media Network, on its DishSMRT Hub and d2h Stream Android set-top box.

Omaxe surged over 10% as the company Signalling a strong real estate demand in Tier II/III cities, India’s leading real estate company Omaxe Limited more than doubled its sales at Rs2,145cr in 2019-20.

Bank of Baroda gained over 10% as the Bank has revised Marginal Cost of Funds Based Lending Rate (MCLR) w.e. f. December 12, 2020.

ITC Limited rose over 8% after Credit Suisse upgraded the stock to 'outperform' from 'neutral'.