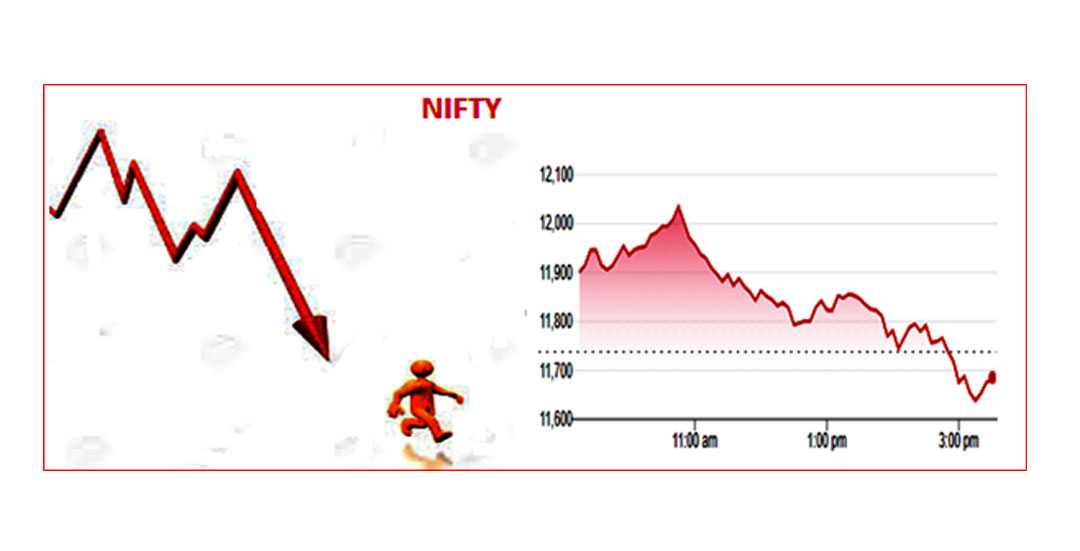

NIFTY TOUCHED 12000 LEVEL IN TODAY’S TRADING SESSION.

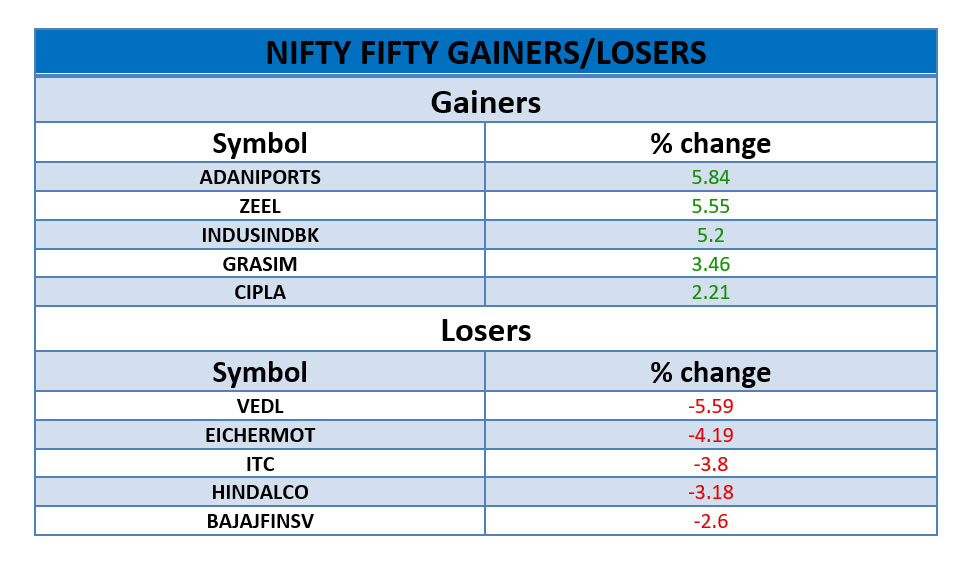

Nifty fifty closed at 11,657.05, recorded a loss of 0.69% which was earlier opened at 11,901.30.Nifty Fifty ended with a negative note as they wiped out all its intraday gains after hitting record highs in the morning trade. Sectorial Indexes like Media, Realty Indexes were the gainers with a gain of 1.32%, 0.47% respectively while Pharma, Energy, Auto, Bank, IT, Metal, FMCG Indexes were the losers with a loss of 0.16%, 0.26%, 0.36%, 0.39%,0.81%, 1.48%, 1.73% respectively.

Nifty fifty closed at 11,657.05, recorded a loss of 0.69% which was earlier opened at 11,901.30.Nifty Fifty ended with a negative note as they wiped out all its intraday gains after hitting record highs in the morning trade. Sectorial Indexes like Media, Realty Indexes were the gainers with a gain of 1.32%, 0.47% respectively while Pharma, Energy, Auto, Bank, IT, Metal, FMCG Indexes were the losers with a loss of 0.16%, 0.26%, 0.36%, 0.39%,0.81%, 1.48%, 1.73% respectively.

Media Index emerged as the top gainer of this Index with a gain of 1.32%. Shares of Dish TV, Zee Limited, DB corp., Network18,PVR, Navneet Education Limited, TV18

Broadcast were the gainers with a gain of 5.69%, 5.55%, 0.89%, 0.65%, 0.63%, 0.56%, 0.51% respectively while shares of Hathway, Jagran, Zee Media, TV Today, Inox Leisure, Eros Media, DEN, Sun TV were the losers with a loss of 4.29%, 3.94%, 2.61%, 2.61%,2.00%, 1.52%, 1.48%, 0.41% respectively.

Media Index emerged as the top gainer of this Index with a gain of 1.32%. Shares of Dish TV, Zee Limited, DB corp., Network18,PVR, Navneet Education Limited, TV18

Broadcast were the gainers with a gain of 5.69%, 5.55%, 0.89%, 0.65%, 0.63%, 0.56%, 0.51% respectively while shares of Hathway, Jagran, Zee Media, TV Today, Inox Leisure, Eros Media, DEN, Sun TV were the losers with a loss of 4.29%, 3.94%, 2.61%, 2.61%,2.00%, 1.52%, 1.48%, 0.41% respectively.

Realty Index has gained 0.47% with shares of DLF, Brigade, Godrej Properties, Mahindra Life space, India bulls real-estate, Sobha gained by 4.08%, 1.53%, 0.67%, 0.67%, 0.56%, 0.30% respectively while shares of Oberoi Realty, Prestige, Sun Teck, Phoenix Ltd were the losers with a loss of 2.29%, 0.74%, 0.48%, 0.06% respectively.

Realty Index has gained 0.47% with shares of DLF, Brigade, Godrej Properties, Mahindra Life space, India bulls real-estate, Sobha gained by 4.08%, 1.53%, 0.67%, 0.67%, 0.56%, 0.30% respectively while shares of Oberoi Realty, Prestige, Sun Teck, Phoenix Ltd were the losers with a loss of 2.29%, 0.74%, 0.48%, 0.06% respectively.

Pharma Index has a downward motion during the trading session which recorded a loss of 0.16%. Shares of Divi’s Lab, Cipla, Auro Pharma were the gainers with a gain of 3.56%, 2.21%, 0.90% respectively while shares of Sun Pharma, Glenmark, Biocon, Lupin, Dr. Reddy, PEL, Cadila healthcare were the losers with a loss of 1.84%, 1.61%, 1.41%, 1.22%, 1.04%, 0.76%, 0.16% respectively.

Pharma Index has a downward motion during the trading session which recorded a loss of 0.16%. Shares of Divi’s Lab, Cipla, Auro Pharma were the gainers with a gain of 3.56%, 2.21%, 0.90% respectively while shares of Sun Pharma, Glenmark, Biocon, Lupin, Dr. Reddy, PEL, Cadila healthcare were the losers with a loss of 1.84%, 1.61%, 1.41%, 1.22%, 1.04%, 0.76%, 0.16% respectively.

Energy Index has lose 0.26% with shares of Reliance Infra, ONGC, Tata Power, IOC, Reliance lose by 5.89%, 1.50%, 0.46%, 0.45%,0.33% respectively while shares of Powergrid, Hindustan Petroleum, BPCL, NTPC, Gail were the gainers in this Index with a gain of 1.32%, 0.54%,0.48%, 0.19%, 0.03% respectively.

Energy Index has lose 0.26% with shares of Reliance Infra, ONGC, Tata Power, IOC, Reliance lose by 5.89%, 1.50%, 0.46%, 0.45%,0.33% respectively while shares of Powergrid, Hindustan Petroleum, BPCL, NTPC, Gail were the gainers in this Index with a gain of 1.32%, 0.54%,0.48%, 0.19%, 0.03% respectively.

Auto Index ended the trading session at 8,839.75, reported a loss of 0.36%. Shares of Hero Moto Corp,Ashok Leyland, TVS Motors, Amara raja Batteries Limited, Apollo Tyre, Exide Industries Limited, Bajaj Auto, Maruti were the gainers with a gain of 1.98%, 0.85%, 0.70%, 0.68%, 0.60%, 0.55%,0.34%, 0.03% respectively while shares of Eicher Motors, Mother Son Sumi System, Tata Motors, Bharat Forg, MRF, Mahindra & Mahindra, Bosch Ltd were the losers with a loss of 4.19%, 3.45%, 2.09%, 1.16%, 0.83%, 0.16%, 0.01% respectively.

Auto Index ended the trading session at 8,839.75, reported a loss of 0.36%. Shares of Hero Moto Corp,Ashok Leyland, TVS Motors, Amara raja Batteries Limited, Apollo Tyre, Exide Industries Limited, Bajaj Auto, Maruti were the gainers with a gain of 1.98%, 0.85%, 0.70%, 0.68%, 0.60%, 0.55%,0.34%, 0.03% respectively while shares of Eicher Motors, Mother Son Sumi System, Tata Motors, Bharat Forg, MRF, Mahindra & Mahindra, Bosch Ltd were the losers with a loss of 4.19%, 3.45%, 2.09%, 1.16%, 0.83%, 0.16%, 0.01% respectively.

Bank Index has witnessed loss of 0.39% which closed at 30,409.10.Shares of IndusInd Bank, YES Bank, ICICI Bank, Bank of Baroda, RBL Bank, Federal Bank, Kotak Bank, SBI were the gainers in this index with a gain of 5.20%, 2.00%, 1.52%, 1.27%, 1.22%, 1.18%, 0.79%, 0.32% respectively while shares of HDFC Bank, IDFC Bank, PNB,Axis Bank were the losers with a loss of 2.32%, 1.76%, 0.77%, 0.39% respectively.

Bank Index has witnessed loss of 0.39% which closed at 30,409.10.Shares of IndusInd Bank, YES Bank, ICICI Bank, Bank of Baroda, RBL Bank, Federal Bank, Kotak Bank, SBI were the gainers in this index with a gain of 5.20%, 2.00%, 1.52%, 1.27%, 1.22%, 1.18%, 0.79%, 0.32% respectively while shares of HDFC Bank, IDFC Bank, PNB,Axis Bank were the losers with a loss of 2.32%, 1.76%, 0.77%, 0.39% respectively.

IT Index has a loss of 0.81% with shares of Infibeam, TCS,Infosys, Tech Mahindra, Tata Elaxi, NIIT Tech,OFSS, Mind tree, Wipro lose by 1.74%, 1.19%,0.84%, 0.66%, 0.52%,0.51%, 0.44%, 0.39%, 0.28% respectively while HCL Tech was the only gainer in this Index with a gain of 0.70%.

IT Index has a loss of 0.81% with shares of Infibeam, TCS,Infosys, Tech Mahindra, Tata Elaxi, NIIT Tech,OFSS, Mind tree, Wipro lose by 1.74%, 1.19%,0.84%, 0.66%, 0.52%,0.51%, 0.44%, 0.39%, 0.28% respectively while HCL Tech was the only gainer in this Index with a gain of 0.70%.

Metal Index has a decent loss of 1.48% in today’s trading session which closed at 2,822.00. shares of Vedanta Limited, Sail, Hindalco, National Aluminium, Tata Steel, Jindal steel were the losers with a loss of 5.59%, 3.44%, 3.18%, 2.60%, 2.02%, 1.05% respectively while shares of Welcorp, Coal India, NMDC, APL Apollo, Jindal stainless limited were the gainers with a gain of 1.73%, 1.53%, 1.43%, 1.31%, 1.23% respectively.

Metal Index has a decent loss of 1.48% in today’s trading session which closed at 2,822.00. shares of Vedanta Limited, Sail, Hindalco, National Aluminium, Tata Steel, Jindal steel were the losers with a loss of 5.59%, 3.44%, 3.18%, 2.60%, 2.02%, 1.05% respectively while shares of Welcorp, Coal India, NMDC, APL Apollo, Jindal stainless limited were the gainers with a gain of 1.73%, 1.53%, 1.43%, 1.31%, 1.23% respectively.

FMCG Index was the topmost loser of today’s trading session which recorded a loss of 1.73%. Shares of Godrej Industries Limited, Jubilant Food works Limited, Emami Ltd, Dabur were the gainers with a gain of 1.16%, 1.05%, 0.15%,0.09% respectively while shares of ITC, UBL, Tata Global, USL, HUL, GSK cons, Marico were the top losers with a loss of 3.80%, 2.92%, 1.32%, 1.32%, 1.01%, 0.98%,0.65% respectively.

FMCG Index was the topmost loser of today’s trading session which recorded a loss of 1.73%. Shares of Godrej Industries Limited, Jubilant Food works Limited, Emami Ltd, Dabur were the gainers with a gain of 1.16%, 1.05%, 0.15%,0.09% respectively while shares of ITC, UBL, Tata Global, USL, HUL, GSK cons, Marico were the top losers with a loss of 3.80%, 2.92%, 1.32%, 1.32%, 1.01%, 0.98%,0.65% respectively.