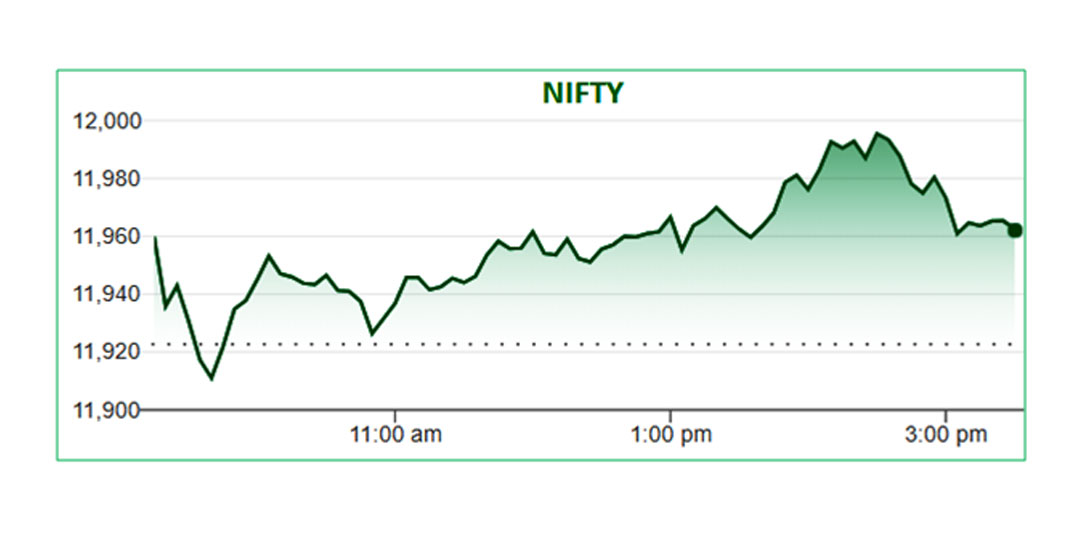

NIFTY FIFTY ROSE FOR THE THIRD CONSECUTIVE SESSION

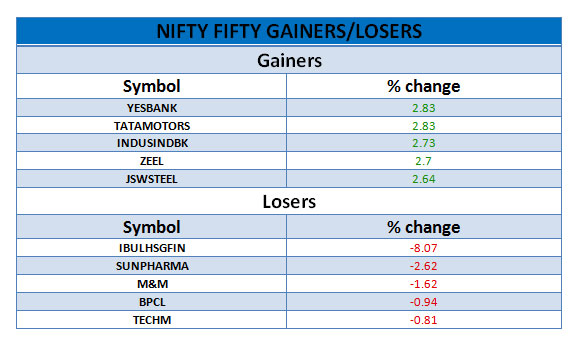

Nifty Fifty has reported a gain of 0.36% to close at 11,965.60 which was previously opened at 11,959.85.Market closed with positive notes lead by gains in Metal and media stocks. Sectorial Indexes like Metal, Media, Bank, Energy, IT, Auto, Realty Indexes were in the gainer side with a gain of 1.32%, 1.31%, 0.75%,0.65%, 0.52%,0.29%, 0.11% respectively whereas Pharma ,FMCG Indexes were in the loser side with a loss of 0.04%,0.16% respectively.

Nifty Fifty has reported a gain of 0.36% to close at 11,965.60 which was previously opened at 11,959.85.Market closed with positive notes lead by gains in Metal and media stocks. Sectorial Indexes like Metal, Media, Bank, Energy, IT, Auto, Realty Indexes were in the gainer side with a gain of 1.32%, 1.31%, 0.75%,0.65%, 0.52%,0.29%, 0.11% respectively whereas Pharma ,FMCG Indexes were in the loser side with a loss of 0.04%,0.16% respectively.

Metal Index was the topmost gainer of today’s trading session which recorded a gain of 1.32%. Shares of Jindal steel, NMDC, Sail, JSW Steel, Vedanta Limited, Tata steel, National Aluminium, APL Apollo, Hindustan Copper, Hindalco were the gainers with a gain of 3.68%,3.36%,3.01%,32.64%,2.42%, 1.38%, 1.32%, 1.14%, 0.84%, 0.66% subsequently while shares of Jindal stainless limited,Welcorp, Moil, Coal india were the losers with a loss of 1.46%,1.35%, 1.16%,0.12% respectively.

Metal Index was the topmost gainer of today’s trading session which recorded a gain of 1.32%. Shares of Jindal steel, NMDC, Sail, JSW Steel, Vedanta Limited, Tata steel, National Aluminium, APL Apollo, Hindustan Copper, Hindalco were the gainers with a gain of 3.68%,3.36%,3.01%,32.64%,2.42%, 1.38%, 1.32%, 1.14%, 0.84%, 0.66% subsequently while shares of Jindal stainless limited,Welcorp, Moil, Coal india were the losers with a loss of 1.46%,1.35%, 1.16%,0.12% respectively.

Media Index recorded a gain of 1.31%. Stocks like Dish TV,TV18 Broadcast, Zee Limited, DB Corp, Hathway were in the gainer side with a gain of 12.69%,4.31%,2.70%,2.39%, 1.43% respectively while Stocks like Eros Media, TV Today, Network18,Zee Media, PVR, DEN, Jagran, Sun TV, Navneet Education Limited, Inox Leisure were in the loser side with a loss of 9.89%,2.47%,2.38%, 1.53%, 1.42%, 1.29%, 1.06%, 1.04%,0.82%, 0.47% respectively.

Media Index recorded a gain of 1.31%. Stocks like Dish TV,TV18 Broadcast, Zee Limited, DB Corp, Hathway were in the gainer side with a gain of 12.69%,4.31%,2.70%,2.39%, 1.43% respectively while Stocks like Eros Media, TV Today, Network18,Zee Media, PVR, DEN, Jagran, Sun TV, Navneet Education Limited, Inox Leisure were in the loser side with a loss of 9.89%,2.47%,2.38%, 1.53%, 1.42%, 1.29%, 1.06%, 1.04%,0.82%, 0.47% respectively.

Bank Index has gained 0.75% with shares of Bank of Baroda, YES Bank, IndusInd Bank, Federal Bank,ICICI bank,PNB,SBI,IDFC Bank,HDFC Bank, Axis Bank, Kotak Bank gained by 2.88%,2.83%, 2.73%, 1.66%, 1.42%, 1.42%, 1.03%, 0.59%, 0.26%, 0.13%, 0.13% respectively while RBL Bank was the only loser with a loss of 0.23%.

Bank Index has gained 0.75% with shares of Bank of Baroda, YES Bank, IndusInd Bank, Federal Bank,ICICI bank,PNB,SBI,IDFC Bank,HDFC Bank, Axis Bank, Kotak Bank gained by 2.88%,2.83%, 2.73%, 1.66%, 1.42%, 1.42%, 1.03%, 0.59%, 0.26%, 0.13%, 0.13% respectively while RBL Bank was the only loser with a loss of 0.23%.

Energy Index recorded a gain of 0.65%. Shares of Reliance Infra, ONGC, IOC, Reliance, Hindustan Petroleum, NTPC were in the positive zone with a gain of 2.58%,2.58%, 1.15%, 0.79%, 0.77%, 0.07% respectively while shares of BPCL, Powergrid, Tata Power, Gail were in the negative zone with a loss of 0.94%,0.44%, 0.38%, 0.24% respectively .

Energy Index recorded a gain of 0.65%. Shares of Reliance Infra, ONGC, IOC, Reliance, Hindustan Petroleum, NTPC were in the positive zone with a gain of 2.58%,2.58%, 1.15%, 0.79%, 0.77%, 0.07% respectively while shares of BPCL, Powergrid, Tata Power, Gail were in the negative zone with a loss of 0.94%,0.44%, 0.38%, 0.24% respectively .

IT Index has an upward tendency during the trading session which recorded a gain of 0.52%. shares of Infibeam, HCL Tech, Tata Elaxi, TCS, Mindtree, NIIT Tech, Wipro, Infosys were having positive notes with a gain of 5.01%,1.54%, 1.03%, 0.92%, 0.36%,0.23%, 0.13%, 0.07% respectively whereas shares of Tech Mahindra, OFSS were having negative notes with a loss of 0.81%,0.13% respectively.

IT Index has an upward tendency during the trading session which recorded a gain of 0.52%. shares of Infibeam, HCL Tech, Tata Elaxi, TCS, Mindtree, NIIT Tech, Wipro, Infosys were having positive notes with a gain of 5.01%,1.54%, 1.03%, 0.92%, 0.36%,0.23%, 0.13%, 0.07% respectively whereas shares of Tech Mahindra, OFSS were having negative notes with a loss of 0.81%,0.13% respectively.

Auto Index has witnessed a gain of 0.29% with shares of Tata Motors, Bharat Forg, Exide Industries Limited, MRF, Hero Moto Corp, Amara raja Batteries Limited, Bosch Ltd, Ashok Leyland, Apollo tyre, Eicher Motors, TVS Motors, Bajaj Auto gained by 2.83%,2.70%,1.38%, 1.22%,1.14%, 0.86%, 0.61%, 0.44%, 0.41%, 0.11%, 0.07%,0.04% respectively whereas shares of Mahindra & Mahindra, Mother Son Sumi System, Maruti were the losers with a loss of 1.62%,0.595, 0.09% respectively.

Auto Index has witnessed a gain of 0.29% with shares of Tata Motors, Bharat Forg, Exide Industries Limited, MRF, Hero Moto Corp, Amara raja Batteries Limited, Bosch Ltd, Ashok Leyland, Apollo tyre, Eicher Motors, TVS Motors, Bajaj Auto gained by 2.83%,2.70%,1.38%, 1.22%,1.14%, 0.86%, 0.61%, 0.44%, 0.41%, 0.11%, 0.07%,0.04% respectively whereas shares of Mahindra & Mahindra, Mother Son Sumi System, Maruti were the losers with a loss of 1.62%,0.595, 0.09% respectively.

Realty Index witnessed a gain of 0.11%.Shares of Sobha, Brigade, DLF, Godrej Properties, Phoenix Ltd, Sun Teck were in the gainer side with a gain of 3.82%, 1.09%, 1.06%, 0.53%, 0.11%, 0.04% respectively while shares of India bulls real-estate, Prestige, Oberoi Realty, Mahindra Life space were the losers with a loss of 4.93%, 1.53%, 1.06%, 0.95% respectively.

Realty Index witnessed a gain of 0.11%.Shares of Sobha, Brigade, DLF, Godrej Properties, Phoenix Ltd, Sun Teck were in the gainer side with a gain of 3.82%, 1.09%, 1.06%, 0.53%, 0.11%, 0.04% respectively while shares of India bulls real-estate, Prestige, Oberoi Realty, Mahindra Life space were the losers with a loss of 4.93%, 1.53%, 1.06%, 0.95% respectively.

Pharma Index has a loss of 0.04% . shares of Auro Pharma, PEL, Cadila healthcare, Cipla, Biocon, Lupin were the gainers, gained by 4.09%,2.38%, 1.98%, 1.34%, 1.10%, 0.20% respectively whereas shares of Sun Pharma, Glenmark, Dr. Reddy, Divi’s Lab were the losers of this Index with a loss of 2.62%,0.83%, 0.69%, 0.39% respectively.

Pharma Index has a loss of 0.04% . shares of Auro Pharma, PEL, Cadila healthcare, Cipla, Biocon, Lupin were the gainers, gained by 4.09%,2.38%, 1.98%, 1.34%, 1.10%, 0.20% respectively whereas shares of Sun Pharma, Glenmark, Dr. Reddy, Divi’s Lab were the losers of this Index with a loss of 2.62%,0.83%, 0.69%, 0.39% respectively.

FMCG Index was the top loser with a loss of 0.16%. Shares of Colgate Palmolive, Tata Global,UBL,Godrej Industries Limited,ITC, Dabur were in the gainer side with a gain of 1.87%,1.15%, 0.785, 0.50%, 0.18%, 0.09% respectively while shares of Jubilant Food works Limited, Emami Ltd, HUL,Goderej Products,Britannia,USL,GSK Cons,Marico,PGHH were in the loser side with a loss of 2.17%,1.02%, 0.78%, 0.78%, 0.48%, 0.15%,0.14%, 0.12%, 0.03% respectively.

FMCG Index was the top loser with a loss of 0.16%. Shares of Colgate Palmolive, Tata Global,UBL,Godrej Industries Limited,ITC, Dabur were in the gainer side with a gain of 1.87%,1.15%, 0.785, 0.50%, 0.18%, 0.09% respectively while shares of Jubilant Food works Limited, Emami Ltd, HUL,Goderej Products,Britannia,USL,GSK Cons,Marico,PGHH were in the loser side with a loss of 2.17%,1.02%, 0.78%, 0.78%, 0.48%, 0.15%,0.14%, 0.12%, 0.03% respectively.