WEEKLY EQUITY REPORT: CORPORATE EARNINGS OF Q1FY20 ALONG WITH GLOBAL CUES DRAGGED THE EQUITY MARKET THIS WEEK

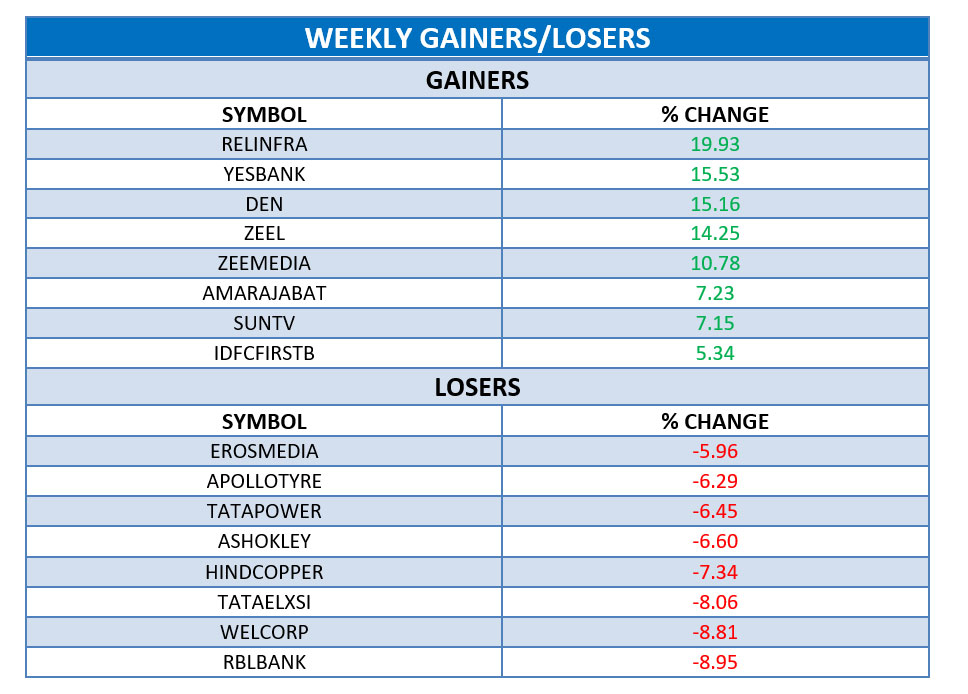

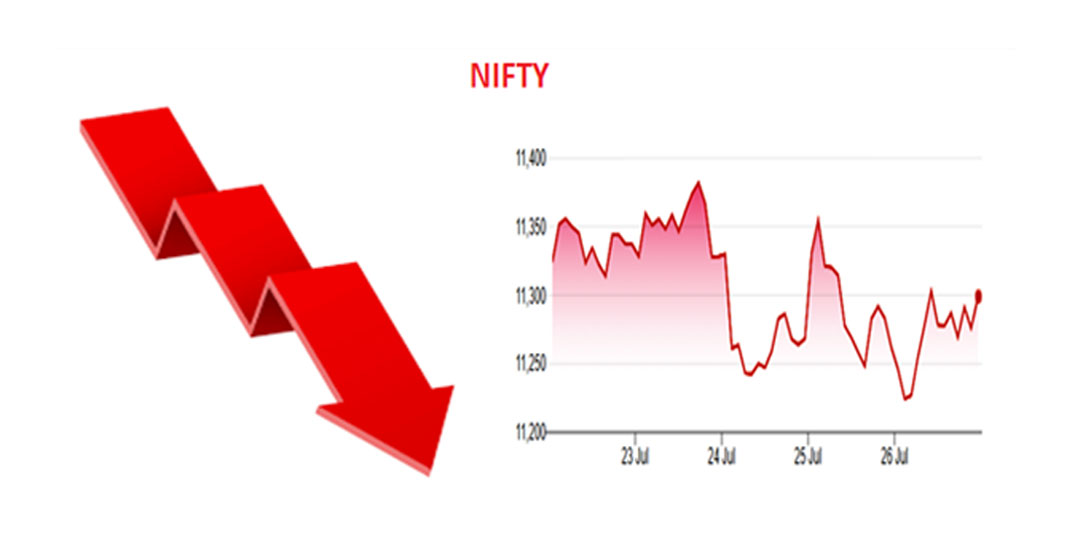

Last week, Nifty fifty reported a loss of 1.53%, During this Week, Nifty fifty witnessed a volatile trading and closed with negative notes by registered a loss of 1.18%. Market closed with negative notes on Monday due to muted global cues, mixed earnings from India Inc along with rise in crude oil price. Market closed with negative notes on Tuesday due to weak corporate earnings, hinting at an economic slowdown along with heavy selling in blue-chip stocks. Market closed with negative notes on Wednesday dragged by auto, metal, energy, banking and pharma stocks as IMF's cut of India's growth outlook dampened sentiments. Nifty fifty ended Thursday's volatile session in the red with corporate earnings and F&O contract expiry guiding the markets' trajectory throughout the day. Nifty ended in green on Friday racking corporate earnings and weakness in global markets. Sectorial Indexes like Media, Pharma, FMCG were the gainers of the week with a gain of 5.61%, 1.73%, 0.40% respectively whereas Energy, Metal, Bank, Realty, Auto, IT Indexes were the losers with a loss of 1.99%, 1.80%, 1.49%, 1.13%, 0.43%, 0.23% respectively.

Last week, Nifty fifty reported a loss of 1.53%, During this Week, Nifty fifty witnessed a volatile trading and closed with negative notes by registered a loss of 1.18%. Market closed with negative notes on Monday due to muted global cues, mixed earnings from India Inc along with rise in crude oil price. Market closed with negative notes on Tuesday due to weak corporate earnings, hinting at an economic slowdown along with heavy selling in blue-chip stocks. Market closed with negative notes on Wednesday dragged by auto, metal, energy, banking and pharma stocks as IMF's cut of India's growth outlook dampened sentiments. Nifty fifty ended Thursday's volatile session in the red with corporate earnings and F&O contract expiry guiding the markets' trajectory throughout the day. Nifty ended in green on Friday racking corporate earnings and weakness in global markets. Sectorial Indexes like Media, Pharma, FMCG were the gainers of the week with a gain of 5.61%, 1.73%, 0.40% respectively whereas Energy, Metal, Bank, Realty, Auto, IT Indexes were the losers with a loss of 1.99%, 1.80%, 1.49%, 1.13%, 0.43%, 0.23% respectively.

TOP STOCKS IN NEWS:

Share price of Reliance Infra rose after 16 lenders signed the Inter-Creditor Agreement (ICA) for the resolution of the company's debt.

Share price of Reliance Infra rose after 16 lenders signed the Inter-Creditor Agreement (ICA) for the resolution of the company's debt.

Yes Bank’s share price up by 15.53% as the company acquired 18.55 per cent stake in Cox & Kings by invocation of pledged shares. The bank has invoked pledge on 3.27 crore equity shares having nominal value of Rs 5 per share.

Yes Bank’s share price up by 15.53% as the company acquired 18.55 per cent stake in Cox & Kings by invocation of pledged shares. The bank has invoked pledge on 3.27 crore equity shares having nominal value of Rs 5 per share.

Tata Elaxi lose 8.06% this week because of the company’s results were below its estimates on both the revenue and profitability front due to degrowth in Auto vertical.

Tata Elaxi lose 8.06% this week because of the company’s results were below its estimates on both the revenue and profitability front due to degrowth in Auto vertical.