WEEKLY EQUITY REVIEW: NIFTY FIFTY WITNESSED THE SECOND WORST WEEK OF 2019.

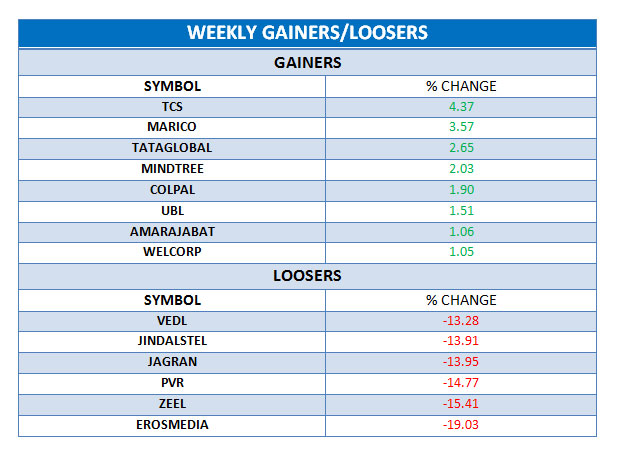

Last week ,Nifty fifty reported a loss of 1.18%, During this Week , Nifty fifty closed with negative notes and witnessed a loss of 2.53%.It touched an high of 11,307.60 and low of 10,848.95 in this week. Equity market traded with negative notes on Monday hit by a fall in auto stocks, persistent selling by foreign investors, muted corporate results, and sharp fall in bond yields. Market ended with negative notes Tuesday as weak corporate earnings and continuous selling by foreign portfolio investors knocked off investment sentiment. Market ended with positive notes on Wednesday due to gain in Metal, Pharma, Auto stocks. Comments made by US Federal Reserve chair on the future trajectory of rate cuts dented market sentiment on Thursday. Market closed with slight gains on Friday after media reports quoting government officials suggested that Prime Minister Office (PMO) and finance ministry’s top bureaucrats are in talks over foreign portfolio investor (FPI) surcharge issue. IT Index was the only gainer of this week with a gain of 0.48% whereas Media, Metal, Realty, Bank, Pharma, Energy, Auto,FMCG Indexes were the losers with a loss of 12.31%, 8.67%,4.30%, 3.82%,3.80%, 3.26%, 3.18% ,0.78% respectively.

TOP STOCKS IN NEWS:

TCS Gained 4.37% as the company launched the Advanced Drug Development (ADD) Site Feasibility Platform, which provides life sciences companies with a single, integrated platform that digitizes the site selection and activation processes, and facilitates data-driven decision-making while assessing site feasibility for multi-site clinical trials.

TCS Gained 4.37% as the company launched the Advanced Drug Development (ADD) Site Feasibility Platform, which provides life sciences companies with a single, integrated platform that digitizes the site selection and activation processes, and facilitates data-driven decision-making while assessing site feasibility for multi-site clinical trials.

Marico surged 2.65% in this week because of healthy Q1 results. The company posted a 21.6% increase in first-quarter net profit to ₹315 crore, led by a stable volume growth in the domestic market.

Marico surged 2.65% in this week because of healthy Q1 results. The company posted a 21.6% increase in first-quarter net profit to ₹315 crore, led by a stable volume growth in the domestic market.

India bulls realestate share price down by 25.18% in this week as the company it will buy back bonds worth up to $ 50 million, which is a part of its $ 1.5 billion bond programme.

India bulls realestate share price down by 25.18% in this week as the company it will buy back bonds worth up to $ 50 million, which is a part of its $ 1.5 billion bond programme.

Share price of Dish TV Slipped 22.63% after the company reported losses in the quarter ended June 2019. The company's Q1 consolidated net loss was at Rs 32 crore against a profit of Rs 37.9 crore in the Q1FY19.

Share price of Dish TV Slipped 22.63% after the company reported losses in the quarter ended June 2019. The company's Q1 consolidated net loss was at Rs 32 crore against a profit of Rs 37.9 crore in the Q1FY19.